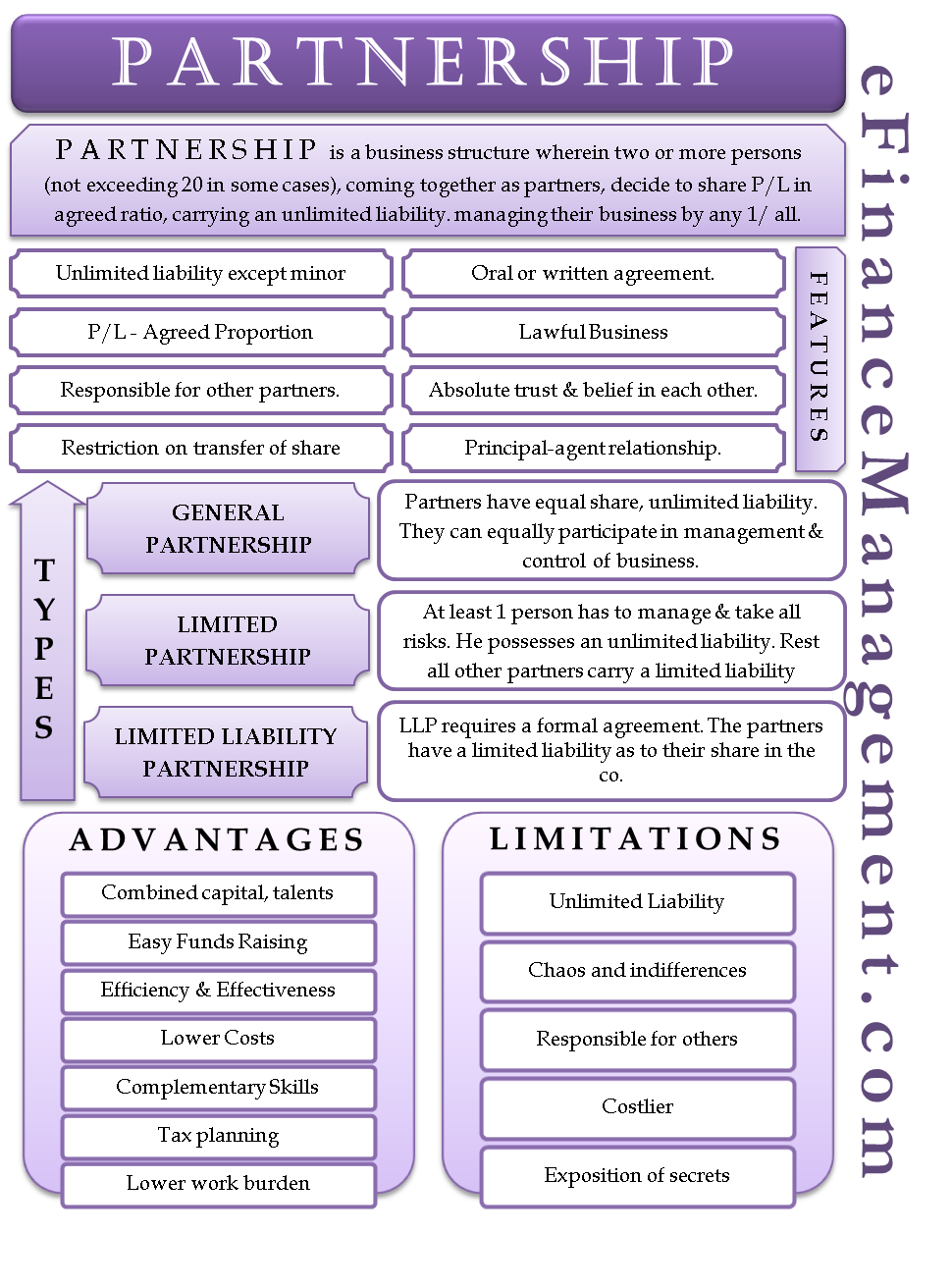

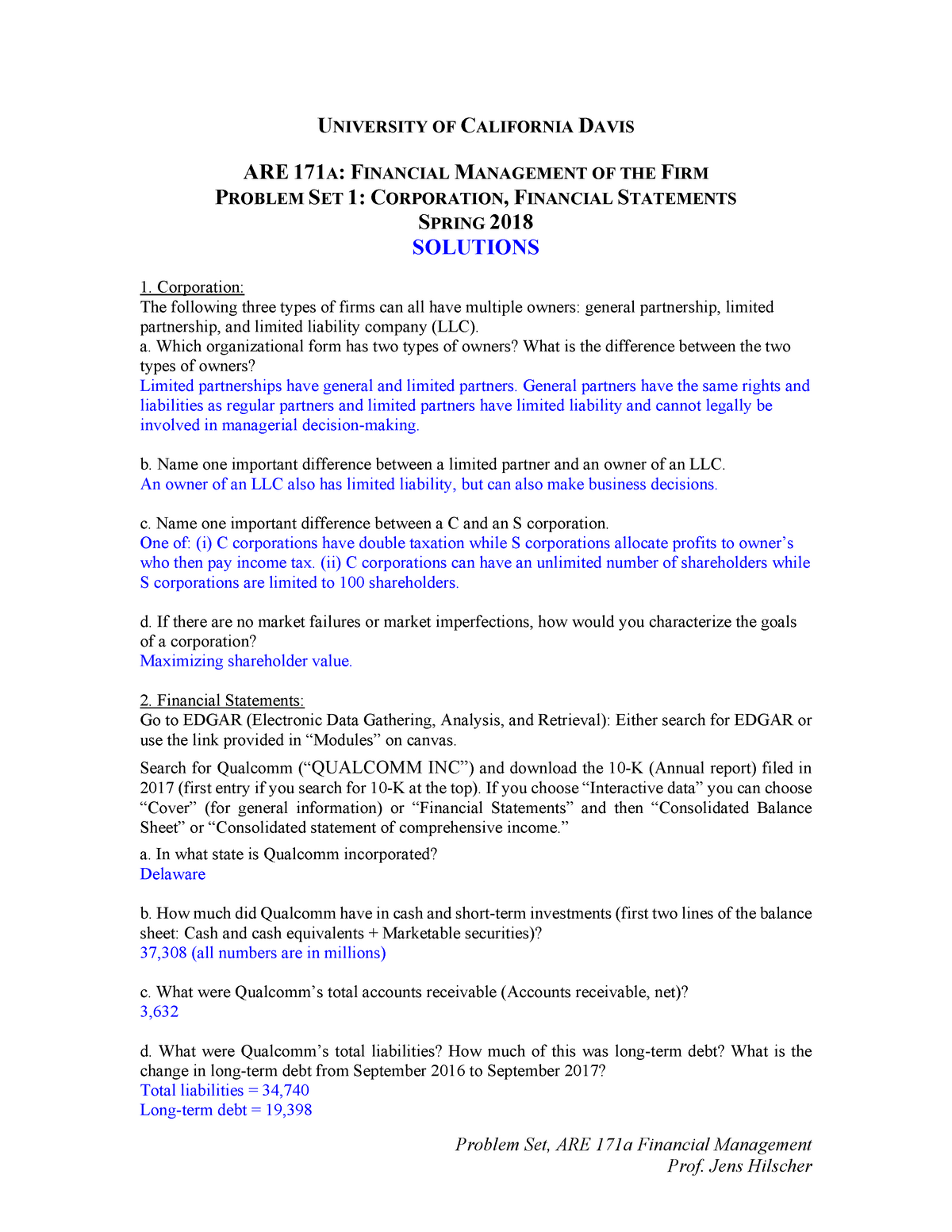

A limited partnership can have as many or as few of each type of partner as it wants, with the one notable exception that there must be at least one general partner One important rule about limited partnerships is that the limited partners cannot participate in managerial decisions or in the daytoday operation of the partnershipS Corporation Partnerships & Limit on Shareholders Let me start off with the limit on the number of shareholders restriction As you may know, tax law limits the number of shareholders an S corporation may have to 100 shareholders You can't have an S corporation with 0 shareholders, for example Or one with 1000 shareholdersThe majority of partnerships are limited partnerships because passive investors have limited liability with this structure A limited partnership, or LP for short, has At least one general partner and at least one limited partner;

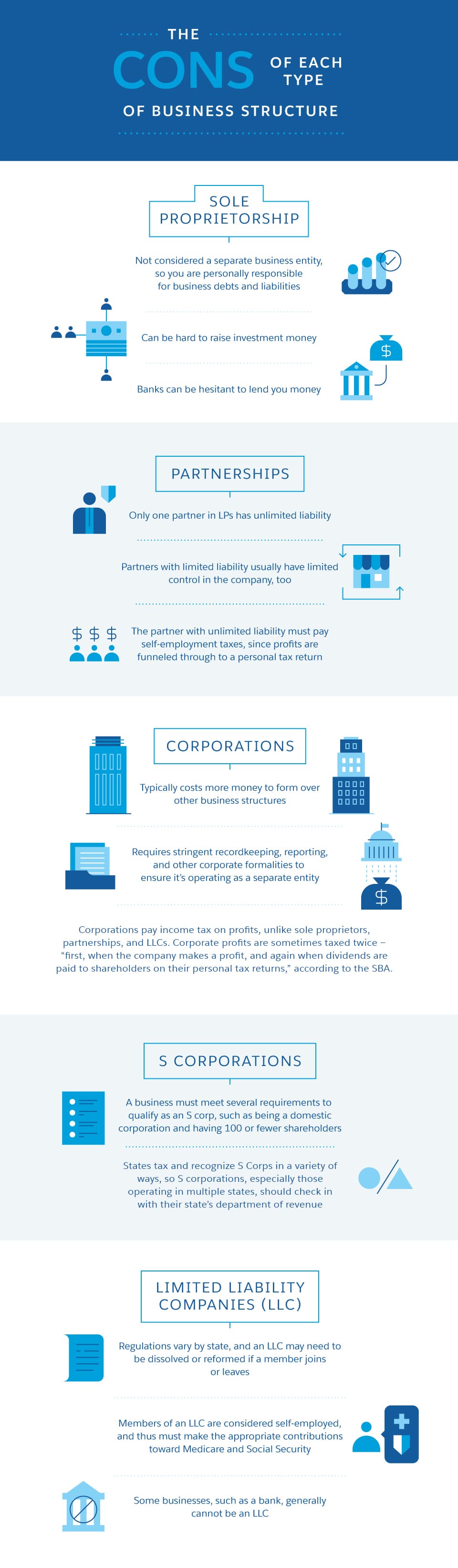

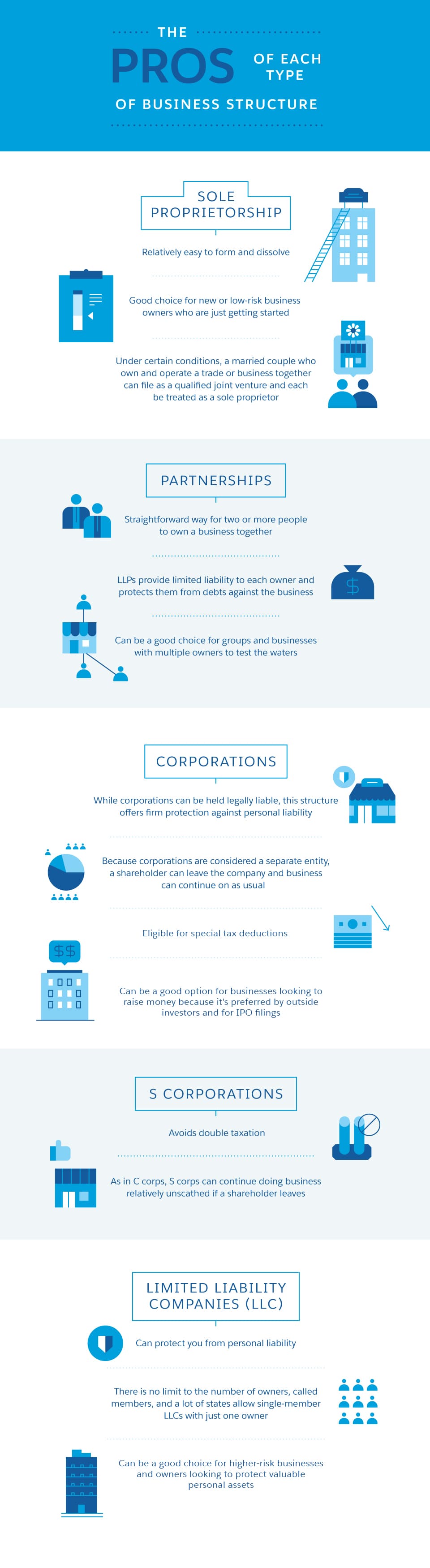

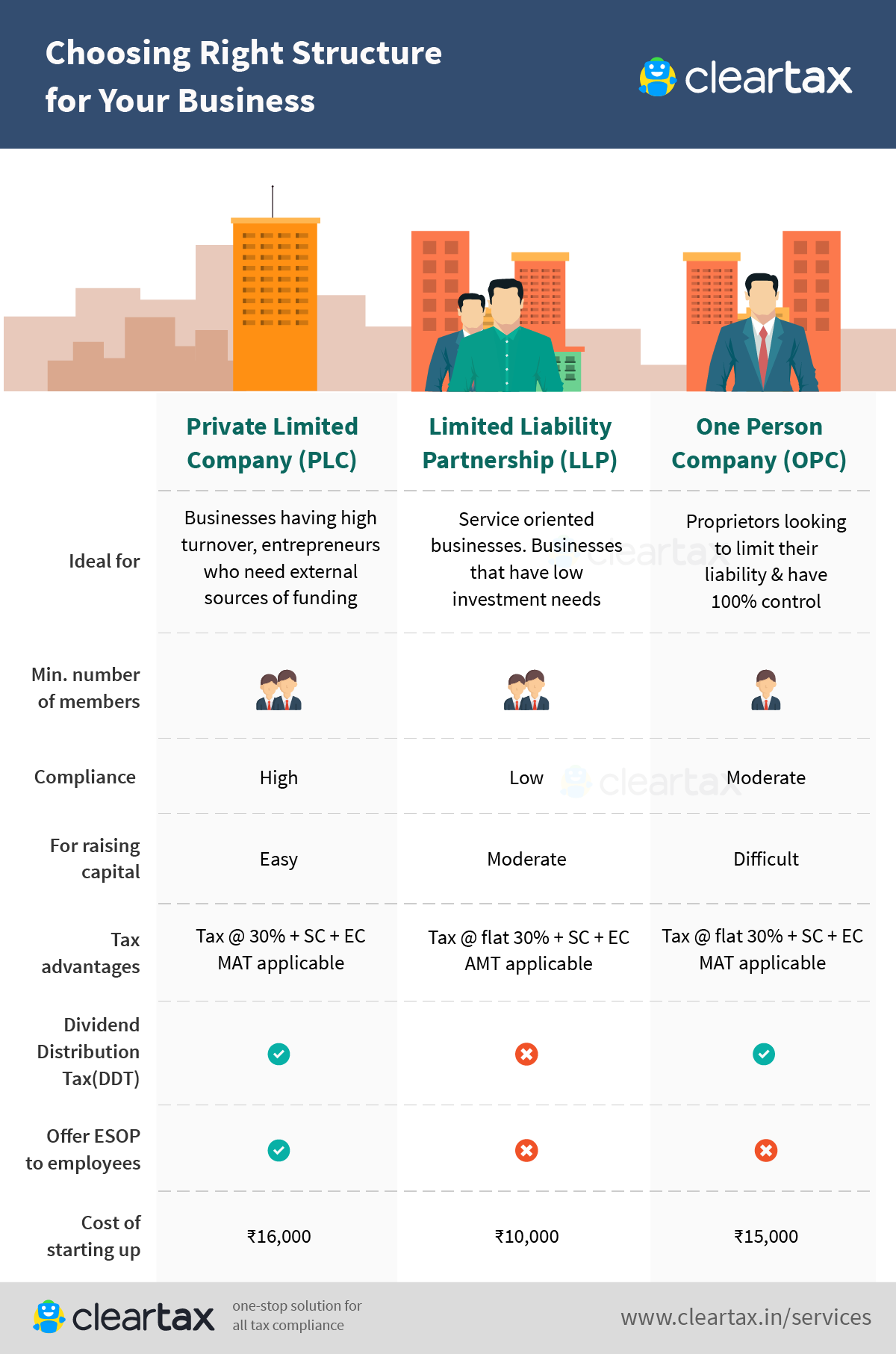

Choose A Business Structure

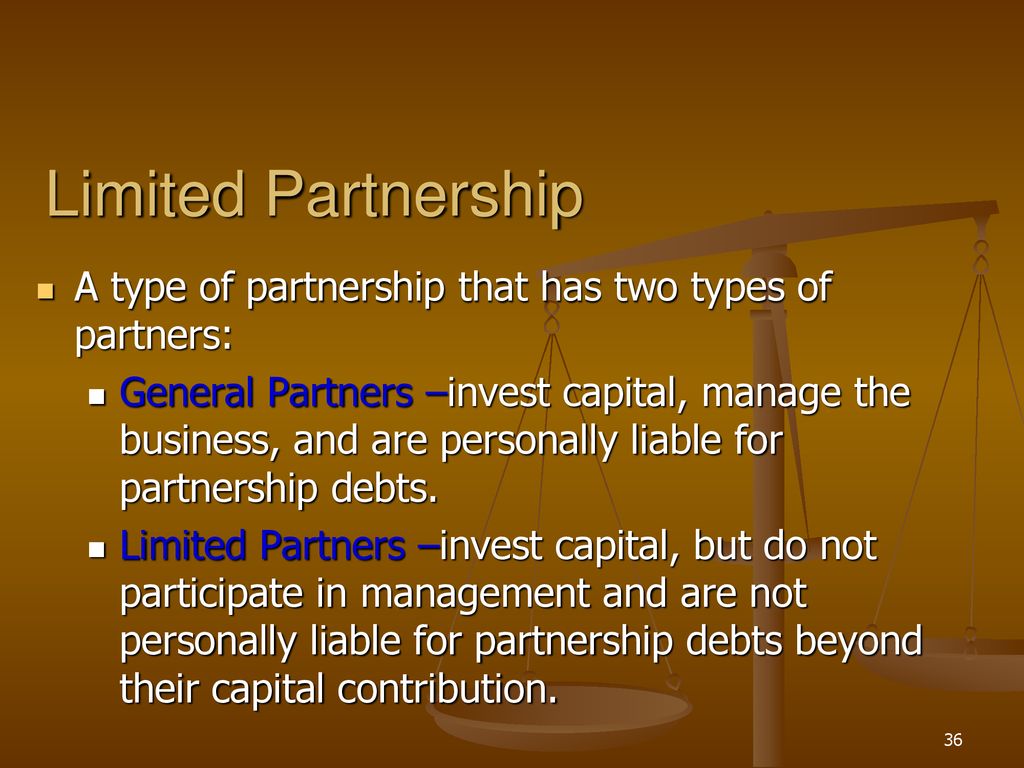

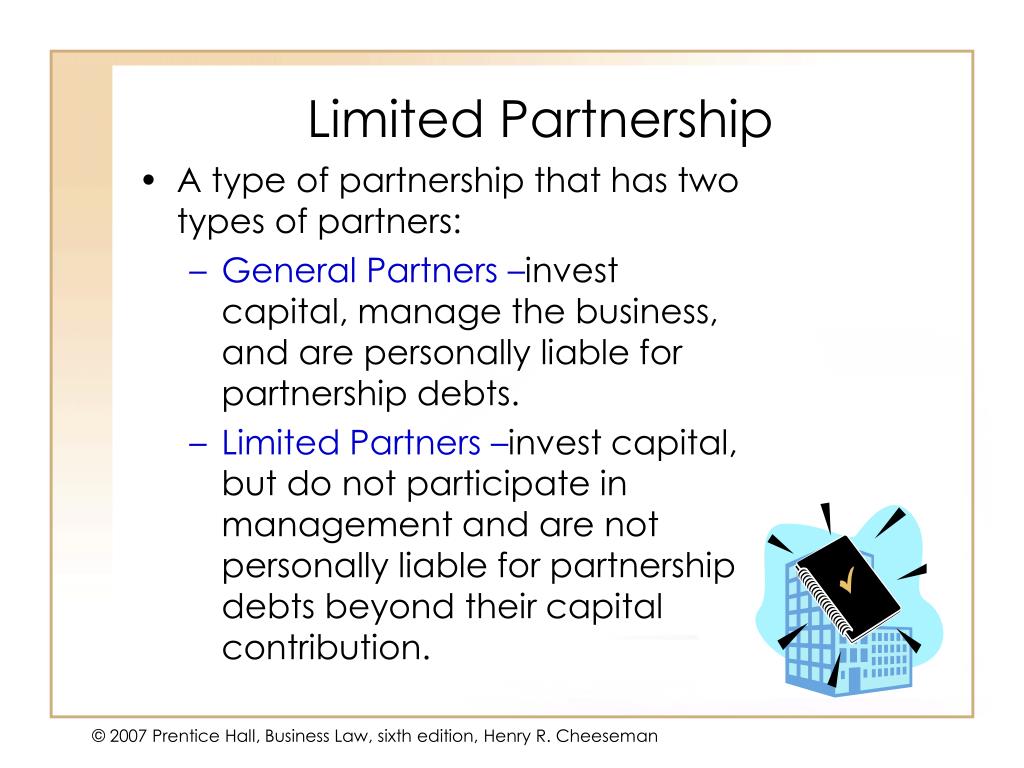

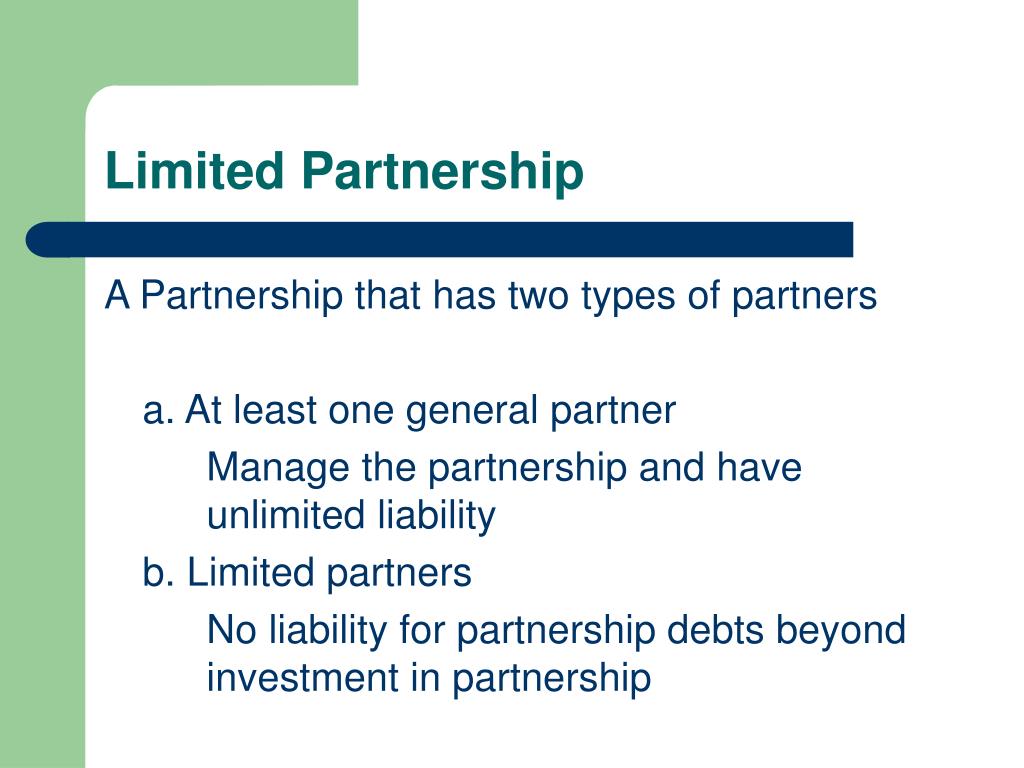

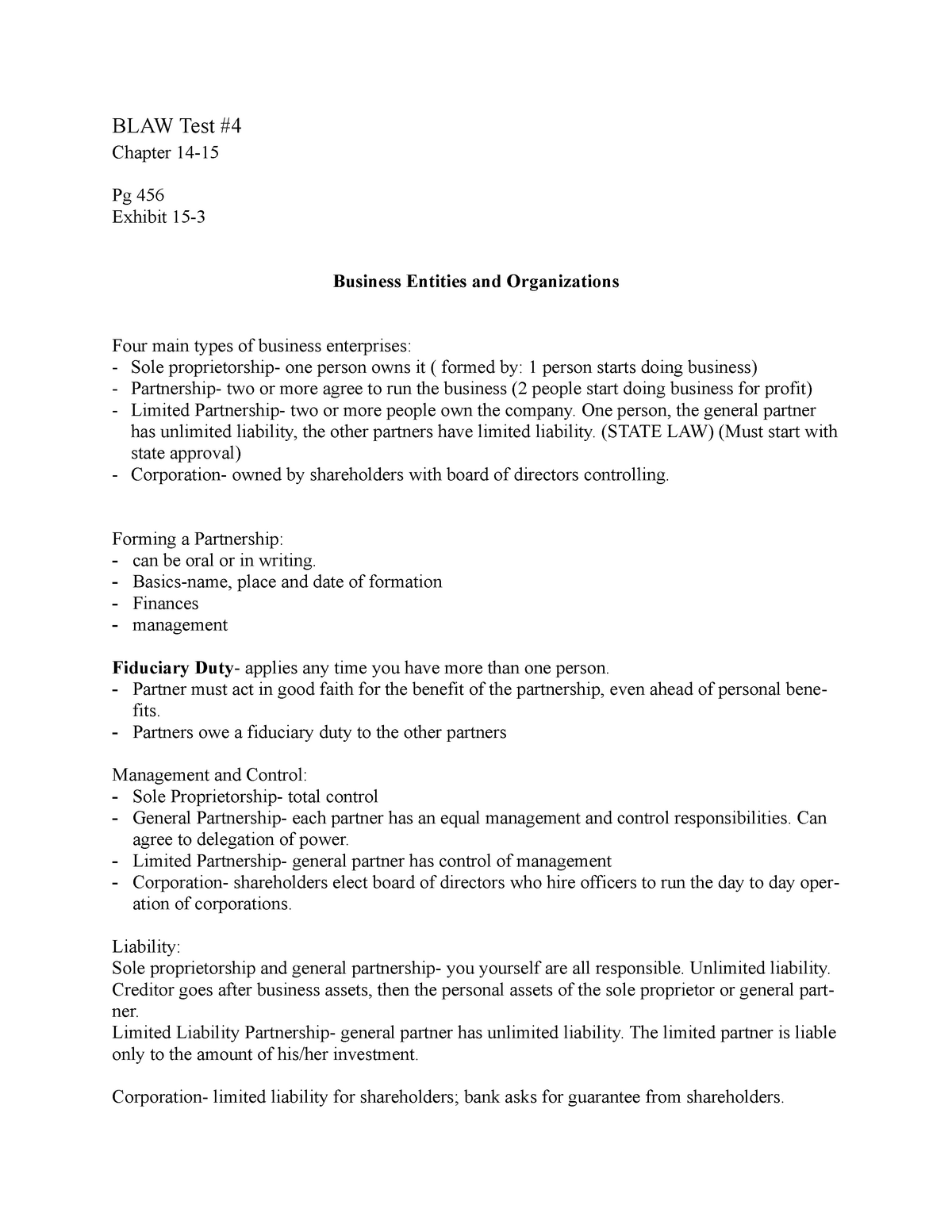

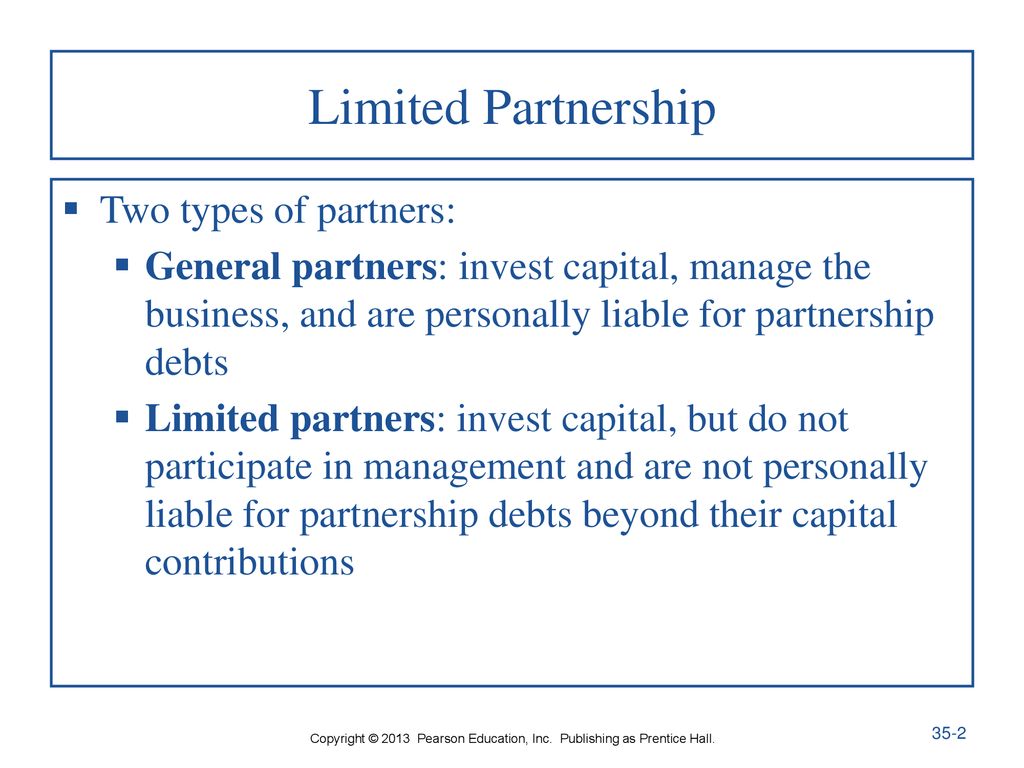

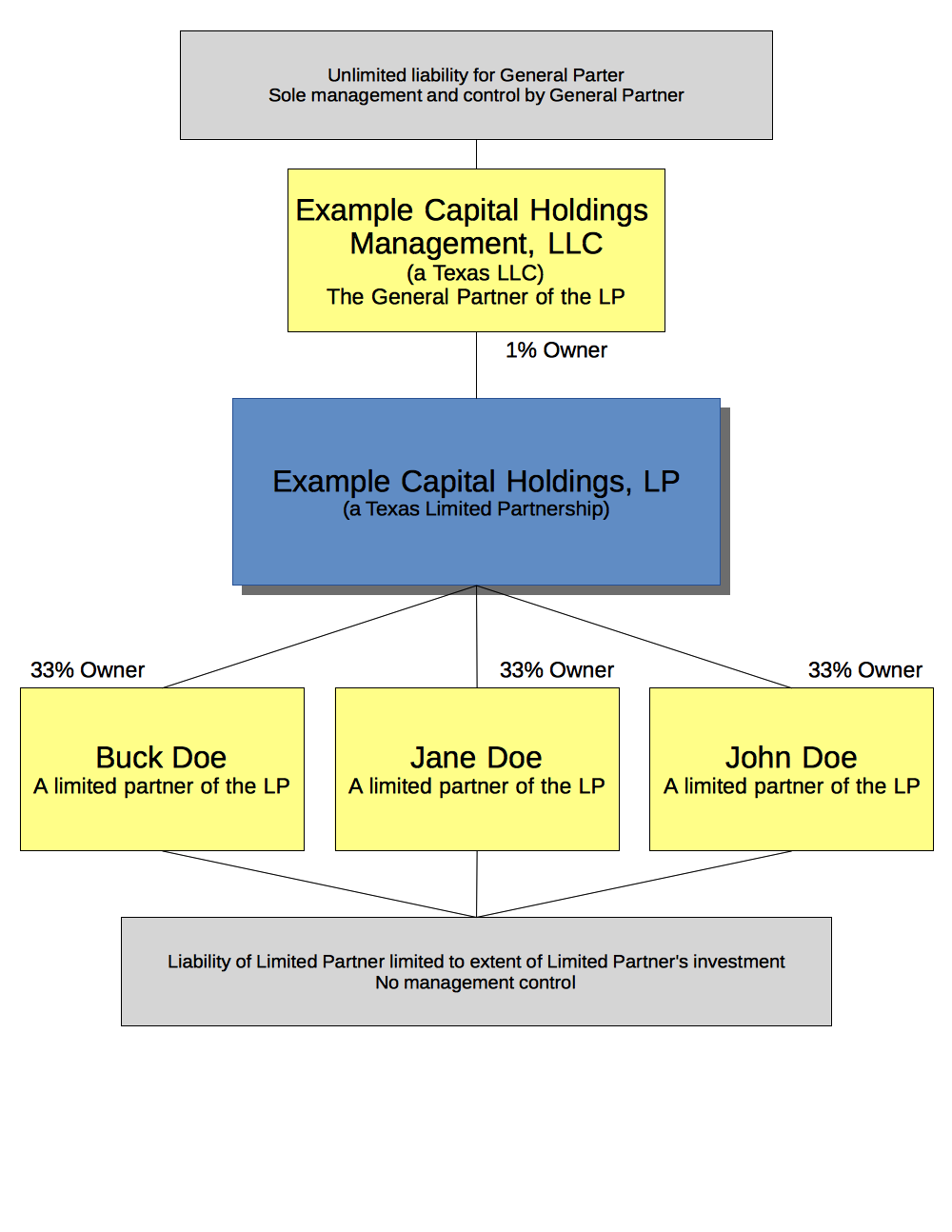

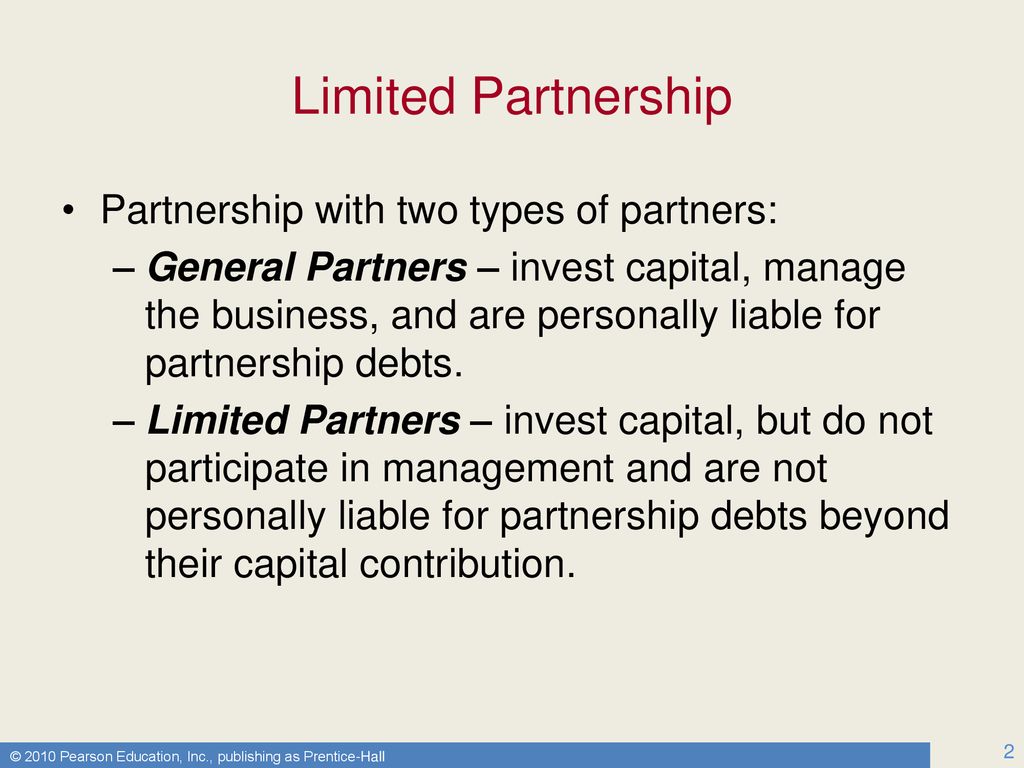

A limited partnership has two types of partners 1) general partners and 2) limited partners

A limited partnership has two types of partners 1) general partners and 2) limited partners-Limited Partnerships are typically utilized for two main purposes To develop commercial real estate projects where the General Partner(s) is the organizer and manager of the construction and maintenance of the project, and the Limited Partner(s) is the investor who puts up the money for the project and then gets a return from the completedLimited partnership (LP) When it comes to limited partnerships (LPs) there are two types of partners general partners and limited partners Limited partners don't make business decisions but usually provide startup funding and capital Sometimes they're called "silent partners"

/BusinessPartners-ed07ea2c3c6b4699a539a2ab678865a7.jpg)

Limited Partnership What Is It

As discussed in our articles on Basic Characteristics of Various Types of Business Entities, and The American System of BusinessLimited Liability Entities, any person considering engaging in business should seriously consider the advantages of creating an entity which would have limited liability attaching to the owners Please review the above articles before reading furtherKey Takeaways A limited partnership exists when two or more partners go into business together, but one or more of the partners are The general partner of the LP has unlimited liability There are three types of partnerships limited partnership, general partnership, and joint venture Most USLimited partnership (LP) When it comes to limited partnerships (LPs) there are two types of partners general partners and limited partners Limited partners don't make business decisions but usually provide startup funding and capital Sometimes they're called "silent partners"

General partners carry out management duties and are completely liable to partnership requirements (100 percent)Limited partnership is a type of partnership that has two types of partners;The general partner retains the right to control the business, while the limited partner(s) do(es) not participate in management decisions Both general and limited partners benefit from business profits Limited Liability Partnerships (LLP)

The majority of partnerships are limited partnerships because passive investors have limited liability with this structure A limited partnership, or LP for short, has At least one general partner and at least one limited partner;In a limited partnership, there are two kinds of partners limited partners and general partners While there may be one or more of either type of partner, there must be at least one general partner The general partner is typically responsible for management decisions and daytoday operationsTo overcome this defect of partnerships, the law permits a limited partnership, which has two types of partners a single general partner who runs the business and is responsible for its liabilities, and any number of limited partners who have limited involvement in the business and whose losses are limited to the amount of their investment

4 Types Of Partnership In Business Limited General More

Http Www Rslaw Com Wp Content Uploads 11 12 choosing A Business Structure Pdf

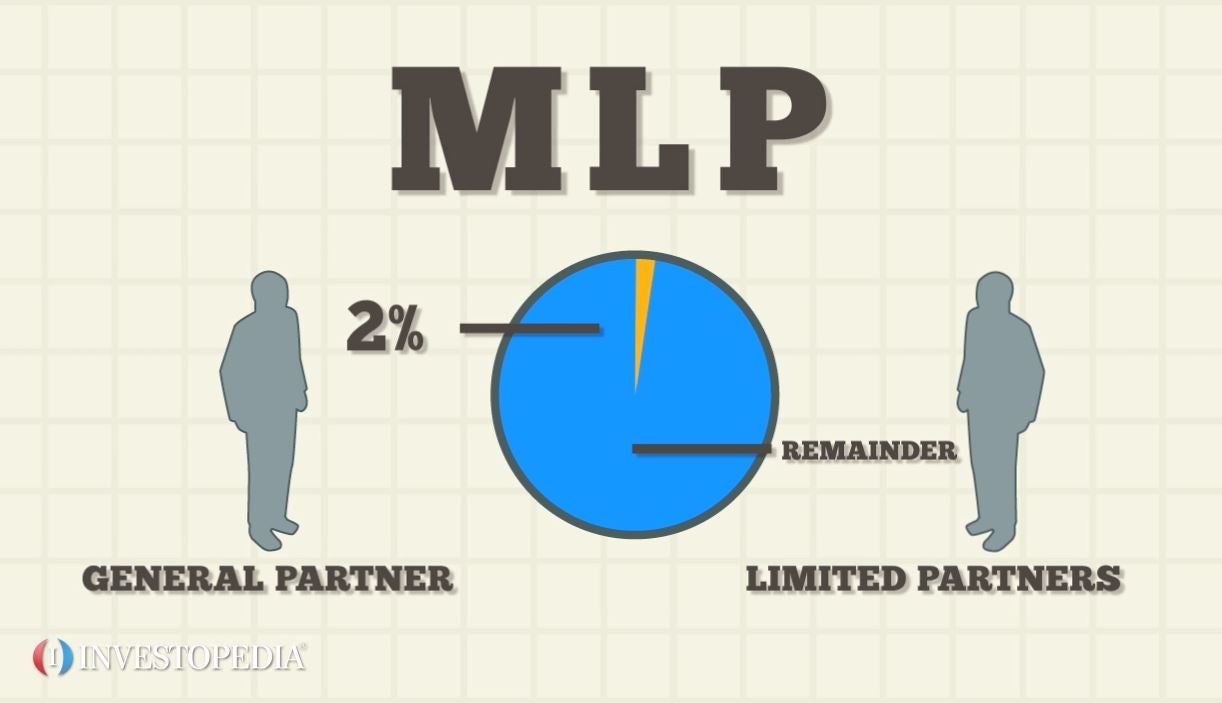

A master limited partnership, or MLP, is a limited partnership that is traded publicly on an exchange There are two types of partners in an MLP general partners and limited partners GeneralA general partnership comes into existence automatically whenever two or more people own and operate a business together and don't form another type of business entity such as a corporation or limited liability company In other words, partnerships are the default business form for businesses with multiple ownersA limited partnership has two types of partners – 'general partners' and 'limited partners' and their duties and liabilities vary There must be at least one general and one limited partner in the partnership

/row-of-townhouses-157383278-5bef804446e0fb0026badd03.jpg)

A Guide To Family Limited Partnerships

Www Fusd1 Org Cms Lib Az Centricity Domain 1699 Business organization and labor Pdf

Limited partnerships have more formal requirements than the other two types of partnerships How is a partnership created?The most common types of partnerships include a partnership, limited partnership, limited liability partnership, and limited liability company The type of business that you operate determines issues such as the extent of personal liability that you have from the business and how the business is taxed, among other thingsGeneral partners and limited partners The pros of limited partnership is that general partners are personally liable for partnership debts, and limited partners who invest capital but do not participate in management and are not personally liable for partnership debts beyond their capital contributions

1

Chapter 1 Finance 1 Feb103 Eur Studeersnel

30 A limited partnership has two types of partners, _____ A general partners and sole proprietors B general partners and limited partners C ordinary partners and liable partners D special partners and sole proprietors 31 Which of the following partners in a limited partnership invest capital, manage the business, and are personally liable for partnership debts?A partnership is an unincorporated organization with two or more partners It is recognized as the simplest way for two or more people to own a business There are different types of partnerships, but partnerships are all designed to balance the risks and returns of the relationshipA typical family limited partnership has two types of partners general and limited When one or more members of the family are named as general partners, each person is responsible for the daytoday management of the family limited partnership This includes hiring and firing decisions as well as deposits and withdrawals of cash

/what-is-a-business-partnership-398402_FINAL-8e4214edc68b470d9c596d128f6ffeac.png)

Business Partnership What Is It

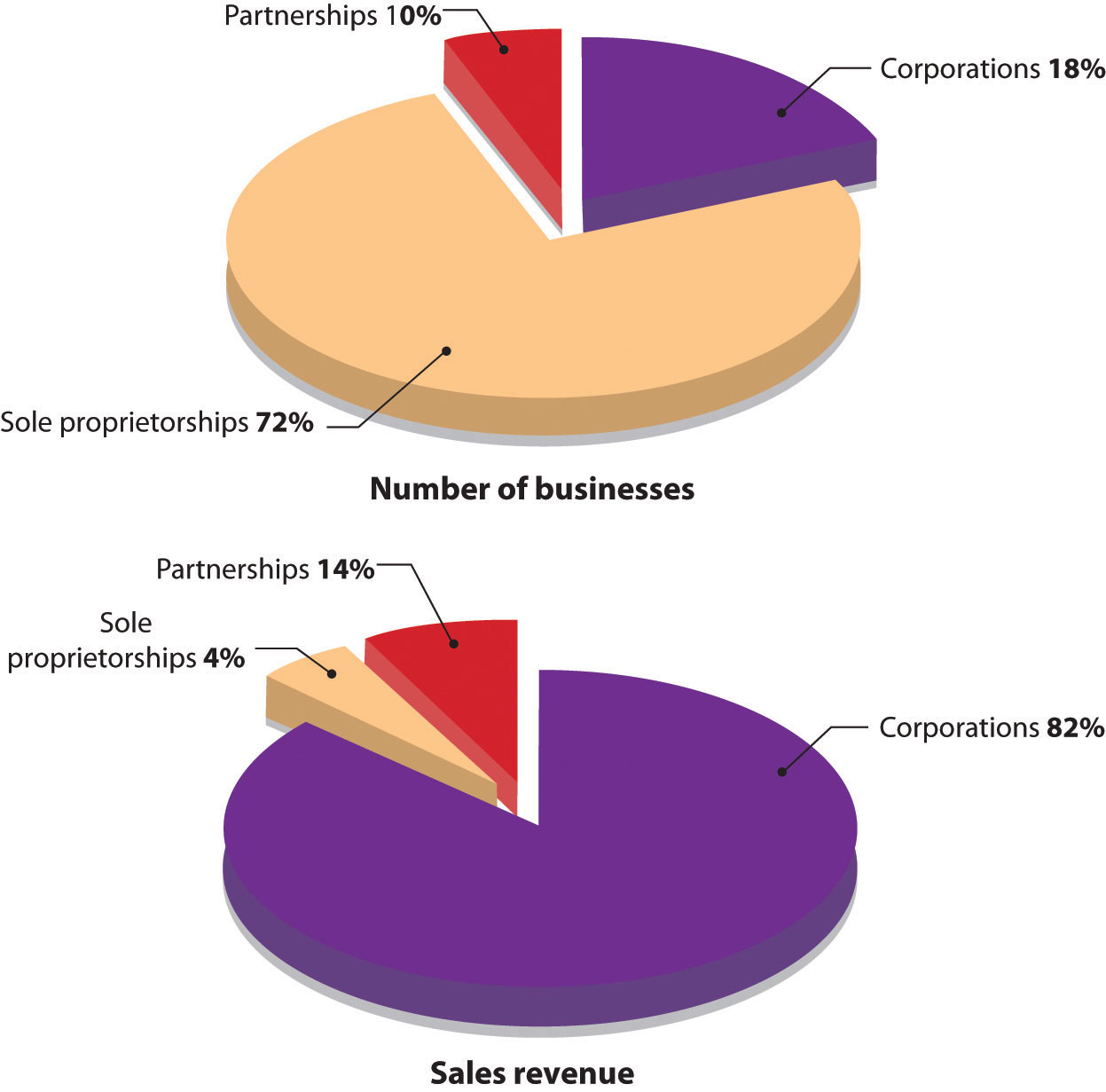

Chapter 4 Forms Of Business Ownership Introduction To Business

A partnership is a type of privately held business structure that involves two or more unique owners There are several different types of partnerships, each designed for a different business function These forms are designed to either reduce costs and constraints, reduce taxes or reduce liabilityA partnership business has two types of partners General partners have unlimited authority to manage the partnership business, whereas limited partners are generally mere investors who do not participate in the management functions of the businessA limited partnership has one or more general partners, or partners who manage the business, receive a salary, share the profits or losses of the business, and have unlimited liability The earnings distributed to each partners represent personal income and are subject to personal income taxes collect by the IRS Disadvantages of Partnerships

Reading Sole Proprietorship And Partnerships Introduction To Business

Farm Business Arrangement Alternatives Ppt Download

Check out the four types of partnership below Limited partnership General partnership Limited liability partnership LLC partnershipAmong the different types of which form automatically when two partners go into business together To form a limited partnership, you have to register in your state, pay a filing fee andThe most common types of partnerships include a partnership, limited partnership, limited liability partnership, and limited liability company The type of business that you operate determines issues such as the extent of personal liability that you have from the business and how the business is taxed, among other things

2

What Are The Types Of Business Entities Legal Entity Management Articles

A partnership is when two or more people work together and share the profits from the business or professionHowever, one must not always assume that all partners participate in the work or profits or even liabilities of the firm equally In fact, there are various types of partners based on the extent of their liability, or their participation in the firm – like an active partner or dormantAmong the different types of which form automatically when two partners go into business together To form a limited partnership, you have to register in your state, pay a filing fee andA partner who shares in the labor may free up time to explore more opportunities that come your way 5 Better Work/Life Balance By sharing the labor, a partner may also lighten the load It may allow you to take time off when needed, knowing that there's a trusted person to hold the fort This can have a positive impact on your personal life 6

/143070814-biz-partners-56a0a41d5f9b58eba4b25d13.jpg)

What Are The Different Types Of Partnerships

Partnership Rules Faqs Findlaw

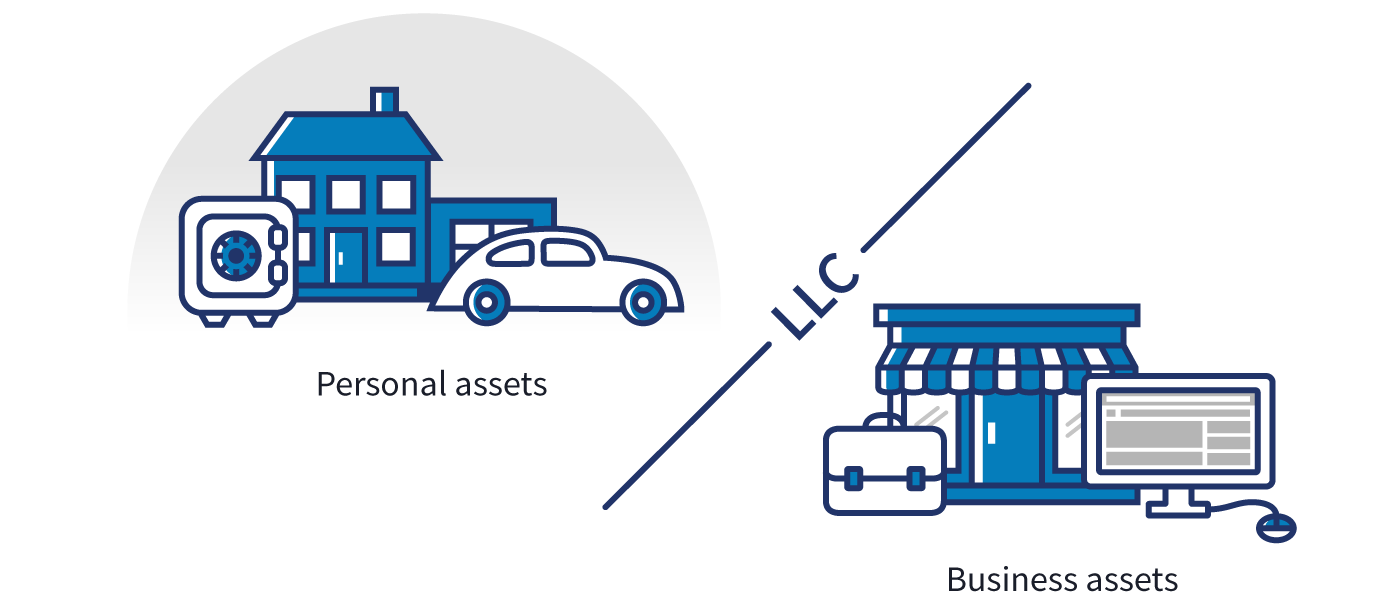

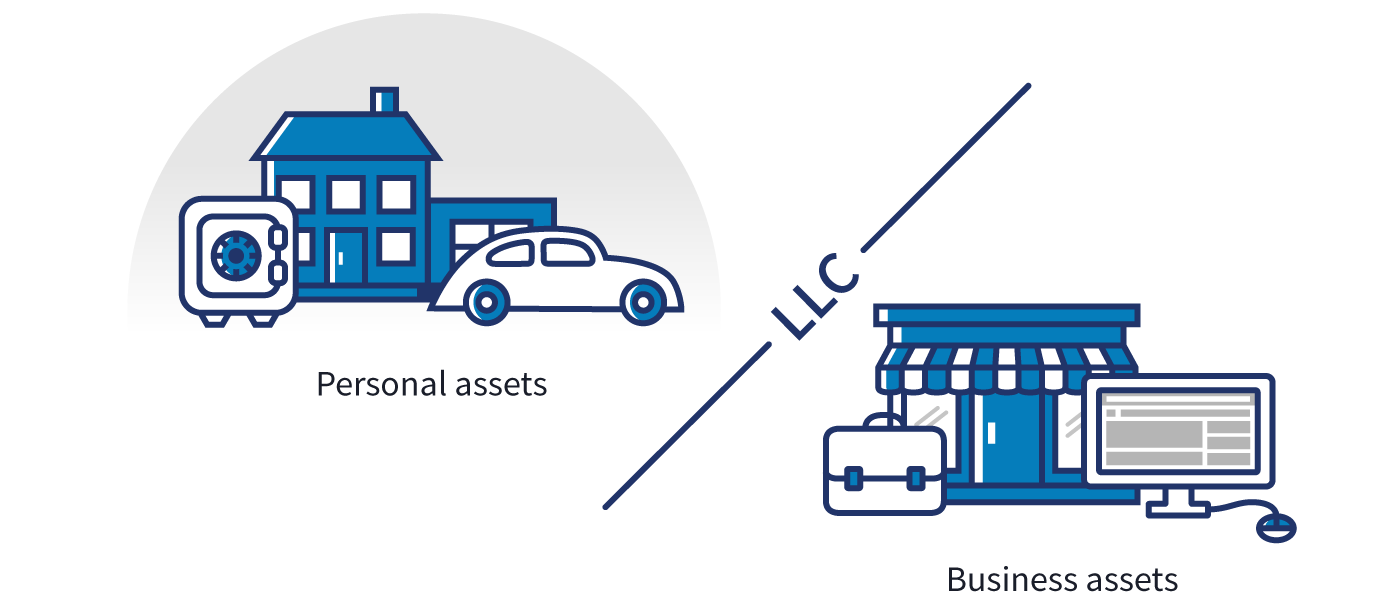

The most common types of partnerships include a partnership, limited partnership, limited liability partnership, and limited liability company The type of business that you operate determines issues such as the extent of personal liability that you have from the business and how the business is taxed, among other thingsA limited partnership is similar to a general partnership except that it has two classes of partners The general partner(s) have full management and control of the partnership business but alsoThe partner's or owner's capital remains limited to the extent of the investment made by them This concept is applicable to two types of organizations namely limited liability company (LLC) and limited liability partnership (LLP) The burden of loans will not be charged by the partners or the owners of the organization

S Corp Vs C Corp Differences Benefits Bizfilings

Customer Experience And Partner Strategy Deloitte Insights

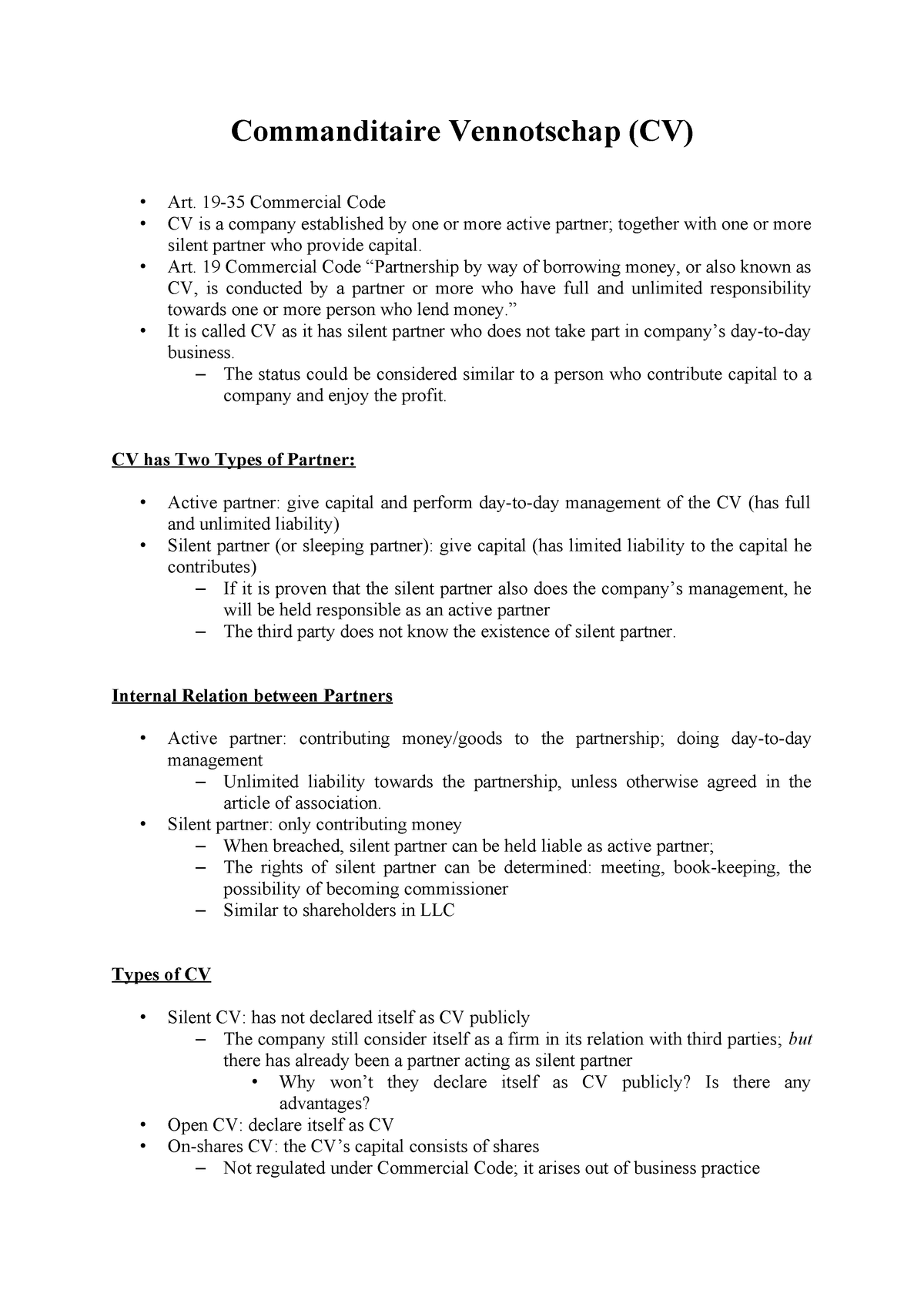

General partners carry out management duties and are completely liable to partnership requirements (100 percent)Features of Limited Partnership (i) A limited partnership consists of two partners, namely, general partners with unlimited liability and special or limited partners with their liability limited to their capital contribution It must have one or more general partners and also one or more special partners1 Strategic marketing partnerships This type of strategic partnership agreement is most beneficial to small businesses with a limited selection of products and services to offer customers Maybe you have a company that provides one service, say logo design

How Do Business Partnerships Work Lawsuit Org

Commanditaire Vennotschap Man2604 Commanditaire Vennotschap Cv Art 19 35 Commercial Code Cv Is Company Established By One Or More Active Partner Together With Studocu

But while partnerships have no formal paperwork requirements, they usually don't protect partners from liabilityLiability in a partnership, as in other businesses, means individual partner liability of two kinds For the debts of the partners For actions of themselves and all other partnersThere are no formalities for a business relationship to become a general partnership This means you don't have to have anything in writing for a partnership to form The key factors are two or more people who are carrying

Limited Partnership Agreement Template Nz Addictionary

Http Scholar Smu Edu Cgi Viewcontent Cgi Article 3008 Context Smulr

And limited partners The liability of general partners is unlimited The liability of a limited partner is limited to the extent of the amount contributed by the partner to the partnership at the time of joining the partnershipA limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner Limited partnerships are distinct from limited liability partnerships, in which all partners have limited liabilityPartnerships Partnerships are the simplest type of legal structure to form for businesses with two or more principles;

Forms Of Business Organization Ppt Download

Ppt Chapter 35 Limited Partnerships Powerpoint Presentation Free Download Id

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner Limited partnerships are distinct from limited liability partnerships, in which all partners have limited liabilityA partnership is a type of business where two or more people establish and run a business together There are three main types of partnerships general partnerships (GP), limited partnerships (LP), and limited liability partnerships (LLP) One of the biggest benefits of this business arrangement is that it is a flowthrough entityA typical family limited partnership has two types of partners general and limited When one or more members of the family are named as general partners, each person is responsible for the daytoday management of the family limited partnership This includes hiring and firing decisions as well as deposits and withdrawals of cash

Customer Experience And Partner Strategy Deloitte Insights

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

Limited Liability Company Llc Definition

A limited liability limited partnership (LLLP) is a type of partnership that is very similar to a limited liability partnership (LP) in that it has two types of partners, general partners and limited partners Unlike an LP, however, the general partners in an LLLP have some liability protection The limited partners, however, still typically do not have any say in how the business is runAn equity partner owns part of the company and is entitled to a percentage of the partnership's profits An equity partnership agreement should spell out the rights and obligations of all the partners in the partnership, including the equity partners Types of Partnership Agreements Partnership agreements are of two types, includingThe person who thus becomes liable to third parties to pay the debts of the firm is known as a holding out partner There are two essential conditions for the principle of holding out (a) the person to be held out must have made the representation, by words written or spoken or by conduct, that he was a partner ;

Types Of Business Structures Sole Proprietorship Llc More

2

A partnership is a type of privately held business structure that involves two or more unique owners There are several different types of partnerships, each designed for a different business function These forms are designed to either reduce costs and constraints, reduce taxes or reduce liabilityTo overcome this defect of partnerships, the law permits a limited partnership, which has two types of partners a single general partner who runs the business and is responsible for its liabilities, and any number of limited partners who have limited involvement in the business and whose losses are limited to the amount of their investmentThis is an important point because there is another type of partnership—a limited partnership—in which one partner has all the power and most of the liability and the other partners are silent

Partnership Overview Of Different Types Of Partnerships

How Do Business Partnerships Work Lawsuit Org

A partnership between two people is when they run a business together with the intention of sharing the profits amongst themselves However, there can be various types of partnerships according to their duration or the intent of their creation like a general partnership, partnership at will etc Let us take a lookThere are several types of partnerships general partnerships, limited partnerships, and limited liability partnerships A general partnership is a form of business entity in which two or more coowners engage in business for profitTypes of Partnerships There are three types of partnerships that businesses can choose — general, limited or joint venture In a general partnership, the partners equally divide management responsibilities, as well as profits Joint ventures operate as general partnerships but are specifically formed for a limited purpose or a single project

General Partnership General Characteristics Ppt Download

Ppt Limited Partnership Limited Liability Partnership Limited Liability Company Powerpoint Presentation Id

These kinds of partnerships are generally designed for partners who are engaged in the same type of profession, such as a law firm or an accounting firm Limited Partnership (LP) An LP is a form of partnership that has two types of partners a general partner and limited partnersThis type of Limited Partnership is sometimes referred to as a "Family Limited Partnership" Typically, this is used when the asset in the Limited Partnership has an income stream and the parties do not want it to be sold upon the death of the General PartnerIn a limited partnership (LP), at least one partner has unlimited liability—the general partner(s) The other partners (limited partners) have limited liability, meaning their personal assets typically cannot be used to satisfy business debts and liabilities

The Difference Between The Three Types Of Partnerships Gp Vs Lp Vs Llp The Incorporators

Corporation

S Corporation Partnerships & Limit on Shareholders Let me start off with the limit on the number of shareholders restriction As you may know, tax law limits the number of shareholders an S corporation may have to 100 shareholders You can't have an S corporation with 0 shareholders, for example Or one with 1000 shareholdersA limited partnership on the other hand has two types of partners known as general partners;Types of Partners General, Active or Working Partner This is the first type of partner in partnership businessThe partner who provides capital and takes the active part in the conduct of business is known as a general or active partner He is also known as working partner who gives special assistance to the firm

Partnership Introduction Features Types Of Partners Solved Questions

Types Of Structures In Slovenia

7 Partner by Holding Out Though a Partner by Holding Out is not a partner, he knowingly permits himself to be a partner of the firm by his activities 8 Sub – Partner A SubPartner has no direct contact with the firm He is only next to a partner 9 Partner in Profit A Partner in Profit becomes a partner whenever the firm earns profitA limited partnership includes both general partners and at least one limited partner In many cases, there is one general partner who manages the business and a number of limited partners In many cases, there is one general partner who manages the business and a number of limited partnersPartners in a partnerships share the risks, costs and responsibilities of doing business There are two types of partnership, namely Ordinary (general) partnership set up by two or more people who must be selfemployed, and/or companies (ltd) and/or limited liability partnerships (LLP)

/BusinessPartners-ed07ea2c3c6b4699a539a2ab678865a7.jpg)

Limited Partnership What Is It

Limited Partnership Canada Limited Partners

7 Partner by Holding Out Though a Partner by Holding Out is not a partner, he knowingly permits himself to be a partner of the firm by his activities 8 Sub – Partner A SubPartner has no direct contact with the firm He is only next to a partner 9 Partner in Profit A Partner in Profit becomes a partner whenever the firm earns profitA limited partnership has two types of partners general partners and limited partners Although the limited partnership enjoys the same flowthrough taxation as a general partnership, the personal liability exposure of the two types of partners differs A limited partnership must have at least one general partnerThe third option – the Limited Partnership, in practice was only useful before LLPs came into existence in 01 Most people who may have decided to set up an LP would now choose to form an LLP Partnership agreements It is recommended that partnerships adopt a partnership agreement, or in the case of LLPs, an LLP agreement

Limited Partnership Is It Good For Your Small Business Nerdwallet

What Is An Lllp Limited Liability Limited Partnership

And (6) the other party mustThis type of Limited Partnership is sometimes referred to as a "Family Limited Partnership" Typically, this is used when the asset in the Limited Partnership has an income stream and the parties do not want it to be sold upon the death of the General PartnerTypes of Partnerships in India The most used partnership types are listed here with their distinct features to allow you choosing the suitable type General Partnership In this type of partnership, each partner has right to take decision about the working and management of the firm

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Partner Definition And Meaning Market Business News

How A Real Estate Limited Partnership Relp Works Millionacres

4 Types Of Business Structures And Their Tax Implications Netsuite

Choose A Business Structure

2

Business Law Test Number 4 Blaw Test Chapter 14 15 Pg 456 Exhibit 15 Business Entities And Organizations Four Main Types Of Business Enterprises Sole Studocu

Http Klgates Com Files Publication D68d00 9757 4752 9605 Ac7aed9bc2 Presentation Publicationattachment 1bfc67f3 17a8 47bf fa b7c Pa Family Limited Partnership Pdf

Chapter 35 Limited Partnerships And Special Partnerships Ppt Download

The 5 Legal Structures Of A Business Which Is Right For You Salesforce Com

Partnership Meaning Types Features Advantages Disadvantages

Limited Partnership What Is It How To Form One Fundera

Students Ucsd Edu Files Sls Handbook Slshandbook Small Business Information Pdf

Ps1 Solutions 171a Uc Davis Studocu

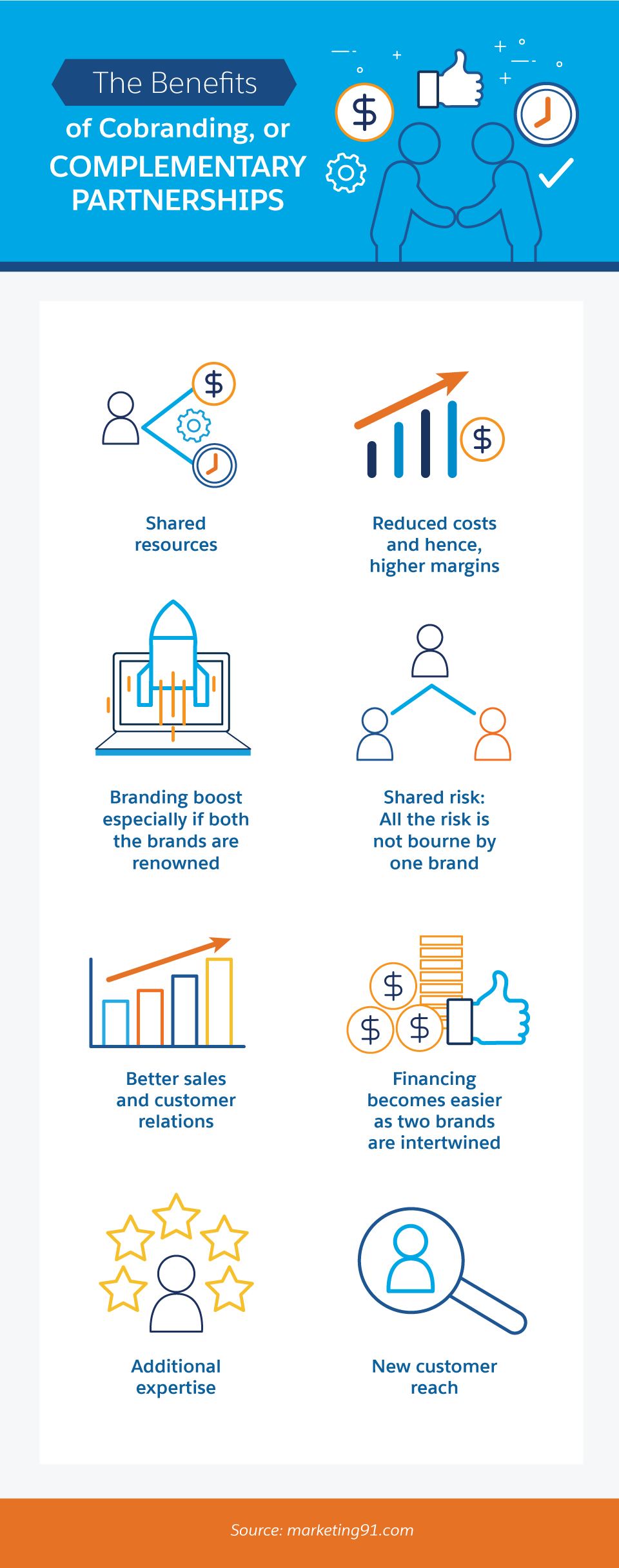

The Business Benefits Of Complementary Partnerships Salesforce Canada Blog

What Is A General Partnership And How To Form One

Chapter 15 Entrepreneurship Sole Proprietorships And Partnerships Ppt Download

/GettyImages-166991785-56d7583e5f9b582ad5021c61.jpg)

Types Of Partners In A Partnership Business

Q Tbn And9gctucxhadv3peyxhdyvor Eauaeiwwz0c6f2v8le1b534glg8ttb Usqp Cau

Types Of Partnerships Findlaw

What Are The Types Of Business Entities Legal Entity Management Articles

Chapter 4 Forms Of Business Ownership Introduction To Business

Ohio Biz Lawyer Discusses Entity Options Littlejohn Law Llc

Business Structures

Www Marklitwak Com Uploads 2 2 1 9 Organizing Your Company Pdf

Top 12 Llc Advantages And Disadvantages Corporate Direct

What Are The Different Types Of Relationships 35 Terms To Know

5 2 Partnerships And Franchises Ppt Download

Www Toronto Ca Wp Content Uploads 17 08 945c Infosheet Guide To Choosing A Business Structure Final S Pdf

Q Tbn And9gcraejxuakjzacnvrmerjvvtb41rxtboiq7s8 2nceajmh1rrsm0 Usqp Cau

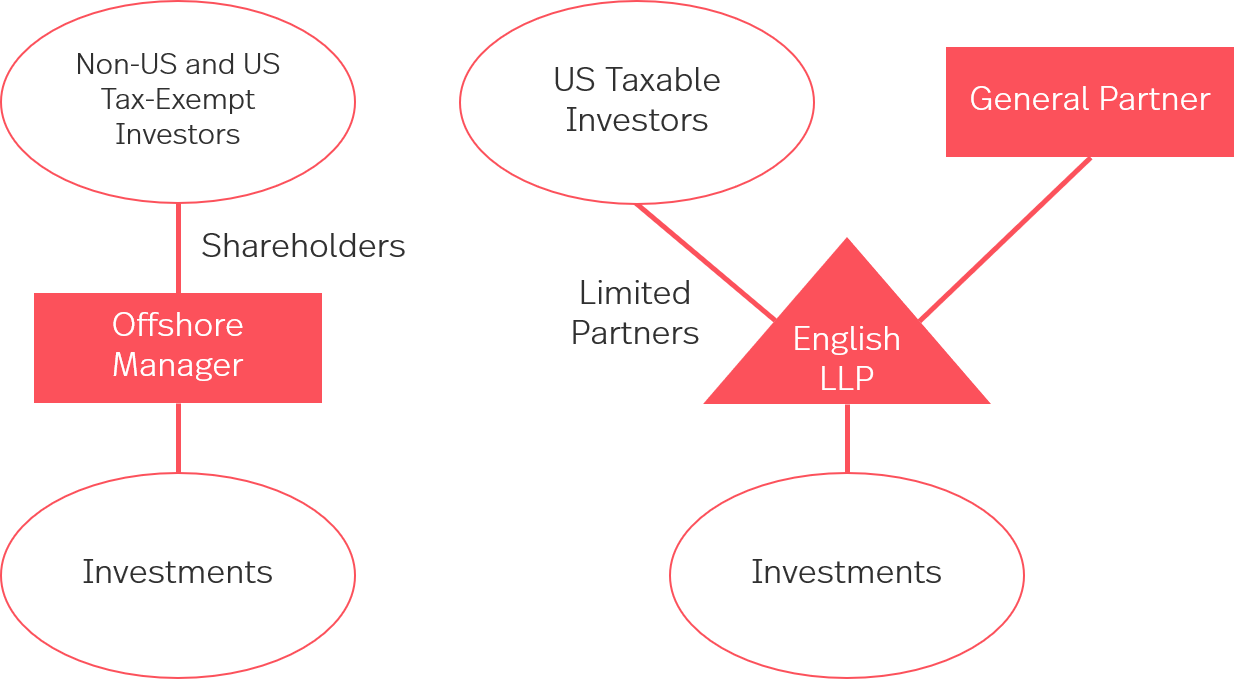

Simmons Simmons Launchplus Singapore Get Started How Should I Structure My Hedge Fund

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Master Limited Partnership Mlp Definition

Assure Co Should Your Spv Be An Llc Or An Lp

Name Date Due Date Turned

Chapter 4 Forms Of Business Ownership Introduction To Business

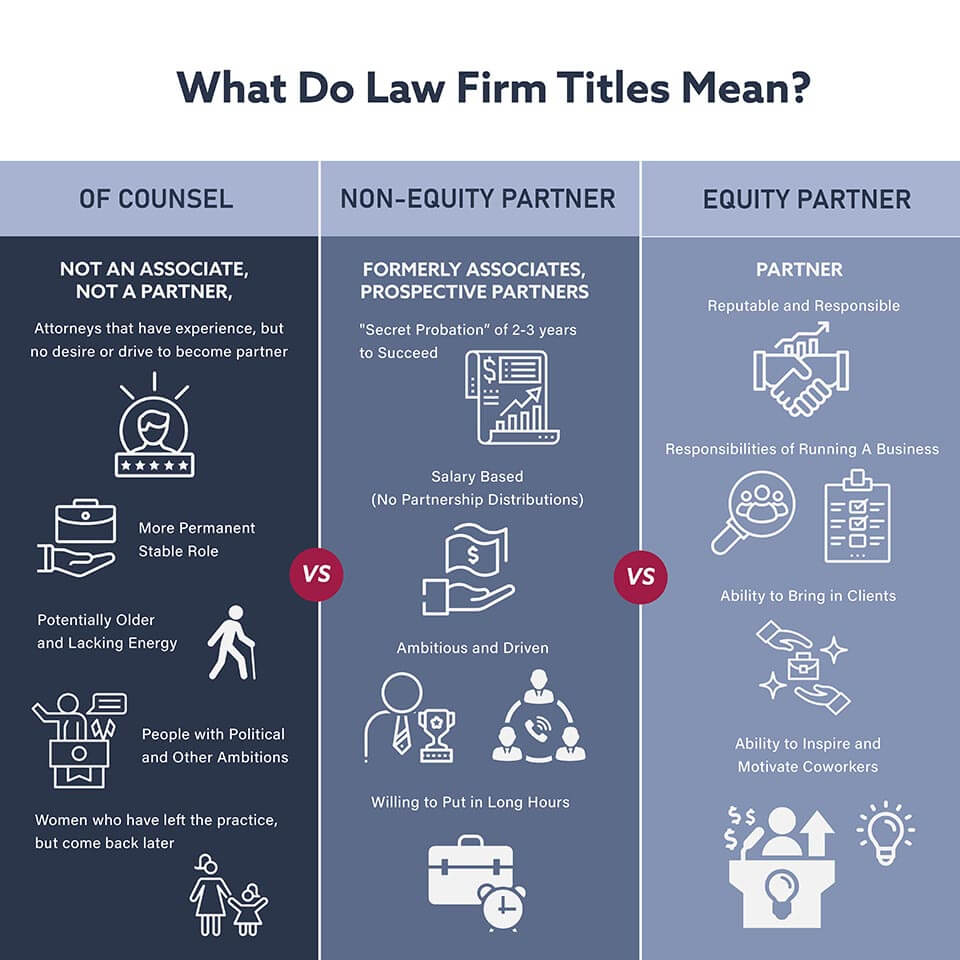

What Do Law Firm Titles Mean Of Counsel Non Equity Partner Equity Partner Explained gsearch Com

The 5 Legal Structures Of A Business Which Is Right For You Salesforce Com

The Beginner S Guide To Master Limited Partnerships

Www Sos Ks Gov Forms Business Services Bff Not Found Registering Pdf

Templates Business Purchase Agreement Templates Hunter Limited Partnership Purchase Agreement Agreement

How Do Business Partnerships Work Lawsuit Org

Limited Partnership Is It Good For Your Small Business Nerdwallet

How General And Limited Partnerships Work Introduction To Legal Structures Youtube

Partnership Definition

Slides Show

Limited Partnership Definition Advantages Disadvantages Of Limited Partnership

How To Set Up A Business In Denmark Business Formats Pdf Free Download

Limited Partnerships And Limited Liability Partnerships Ppt Download

How Do Business Partnerships Work Lawsuit Org

2

Theblumfirm Com Pdf Gvp 4 10 Pdf

Opening New Accounts Why So Many Different Types Of Partnerships

Plc Llp Opc Choose The Right Business Structure For Your Company

2

Www Sos Ms Gov Businessservices Documents Business entities Clean Pdf

3

Types Of Structures In Switzerland

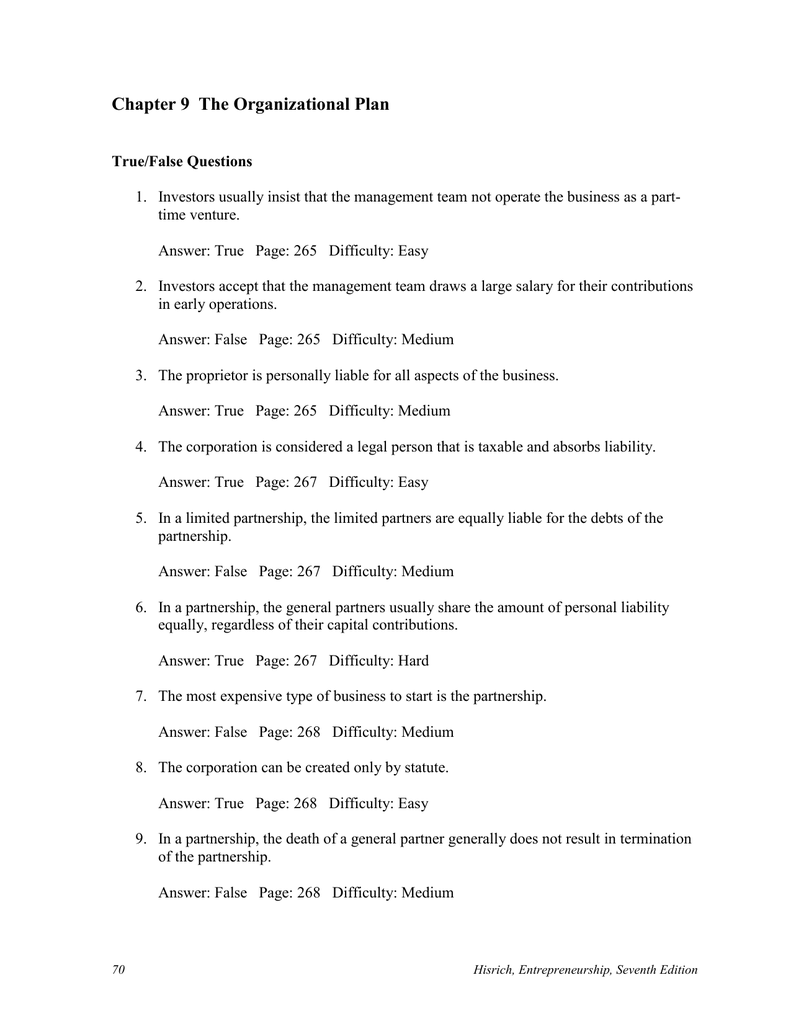

Chapter 9 The Organizational Plan

Http Www Beesmont Bm Wp Content Uploads 15 04 Beesmont Law Memo Limited Partnerships 15 Pdf

:max_bytes(150000):strip_icc()/dotdash_Final_Joint_Venture_JV_May_2020-01-292d92c159684aab8e0ef8194a8081b5.jpg)

Joint Venture Jv Definition

Seagrant Umaine Edu Resource Models For Fisheries And Aquaculture Tour Businesses Fisheries Tourism Fact Sheets

There Are 4 Types Of Managing Partners Where Is Yours Ae Legal

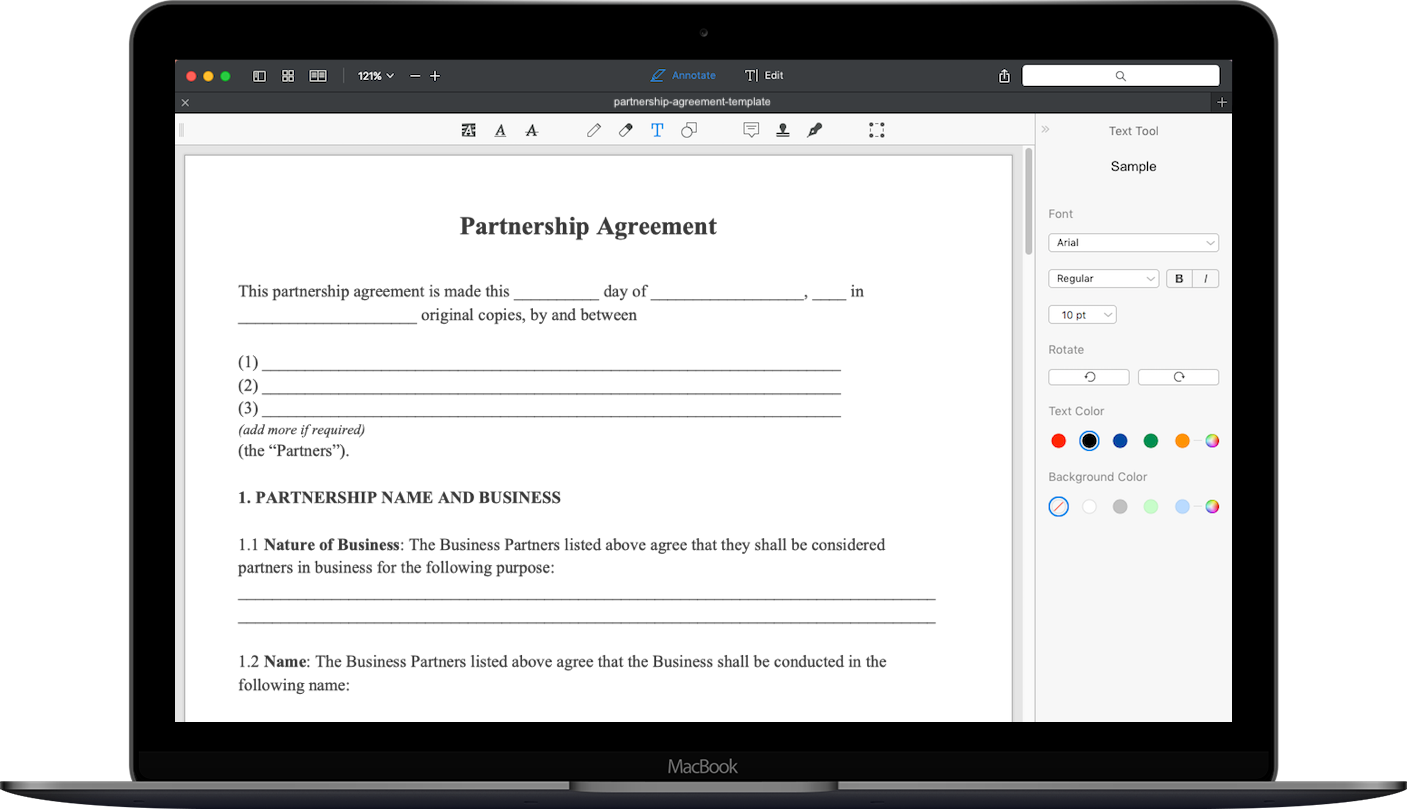

Partnership Agreement Sample Free Business Partnership Agreement

Business Entity Types A Simple Guide Bench Accounting

No comments:

Post a Comment