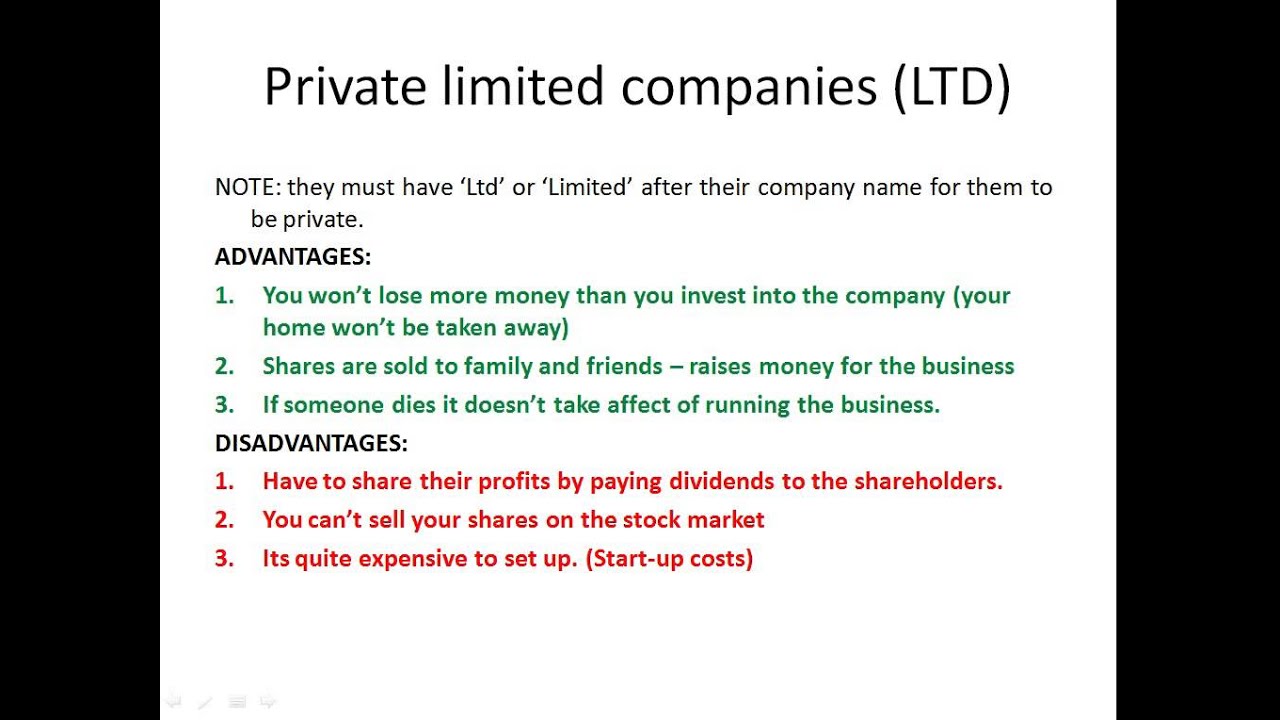

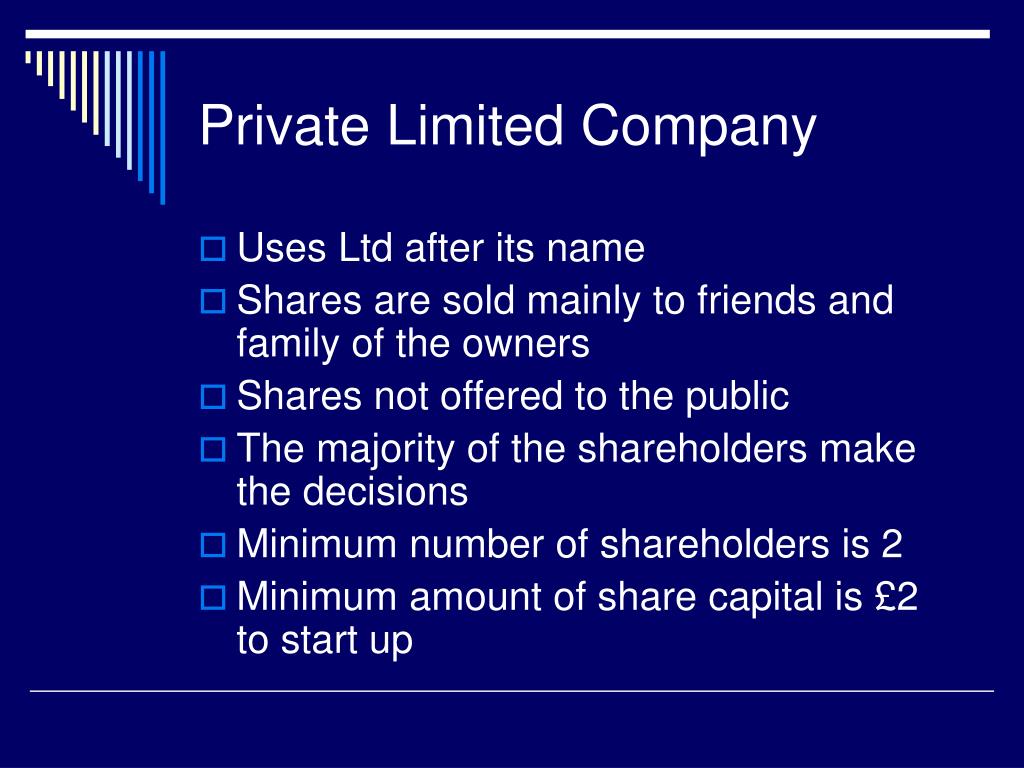

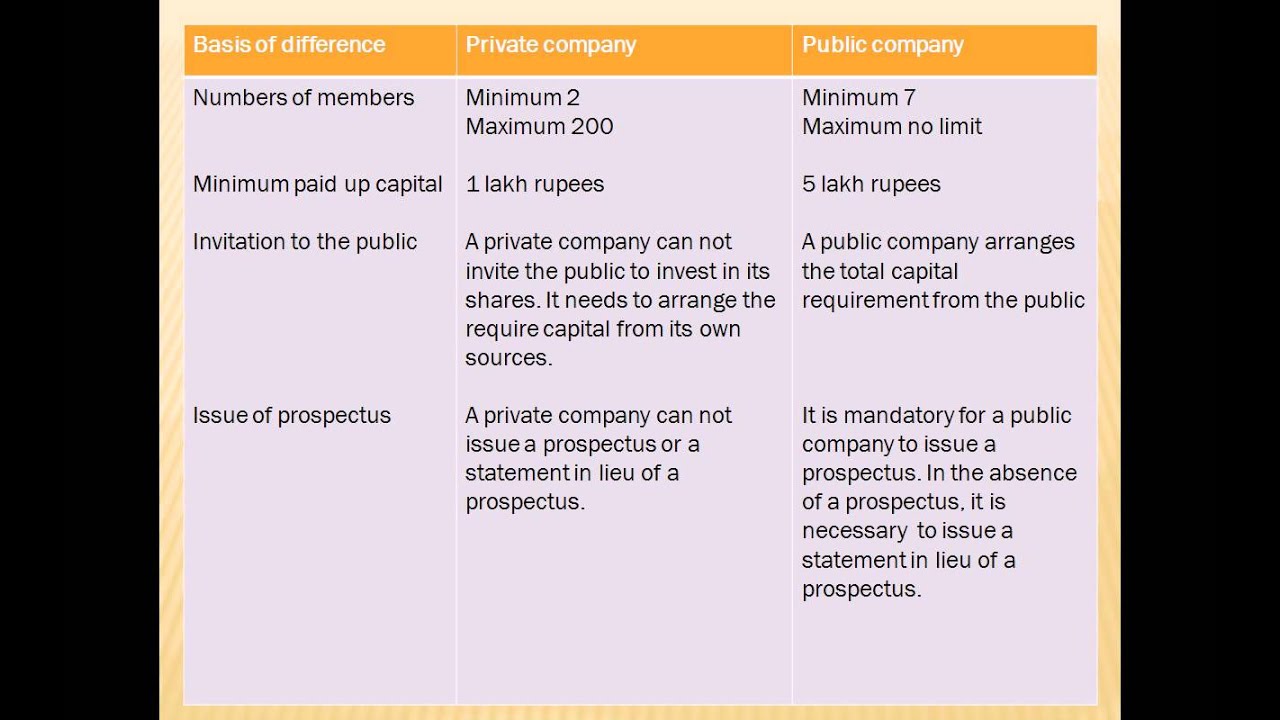

The most popular kind of limited company in the UK is a private limited company, limited by shares Although that is the most popular model of a limited company, there are others that also come under the category of a limited company Here are the different types of limited companies that you can set up and run in the UKThe vast majority of companies in the UK – about 95 percent, all told – are private limited companies The remaining 5 percent are public limited companies Even though the public limited company is a much rarer choice of entity, it offers many benefits that are highly valued by investorsEvery Public Limited Company shall have at least a minimum of 3(three) Directors I'm confused, I would like to know how many directors are required to run a private limited company Reply Delete Replies Trinaath 22 October, 19 Two directors Delete Replies Reply Reply

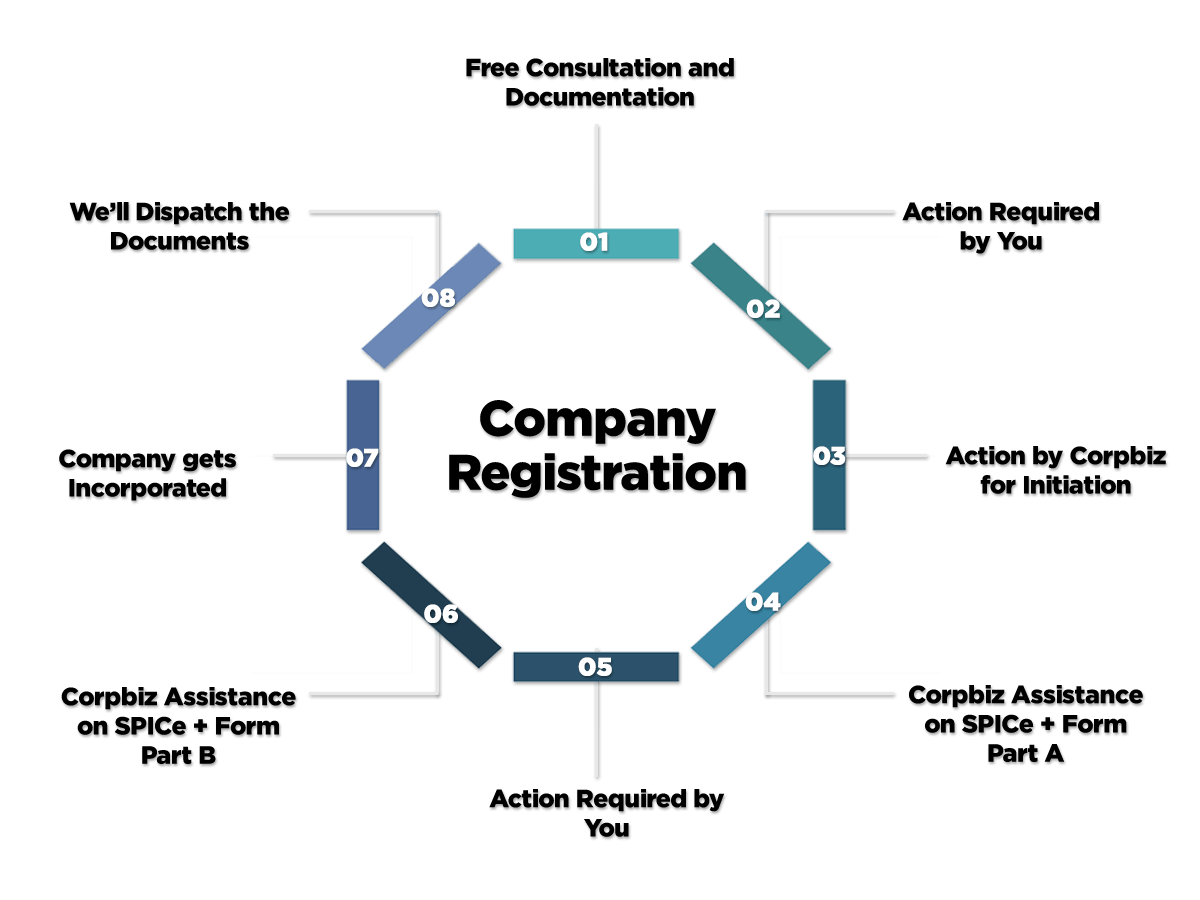

Procedure Of Company Registration In India Private Limited Company Public Limited Company Company

A public company limited by shares

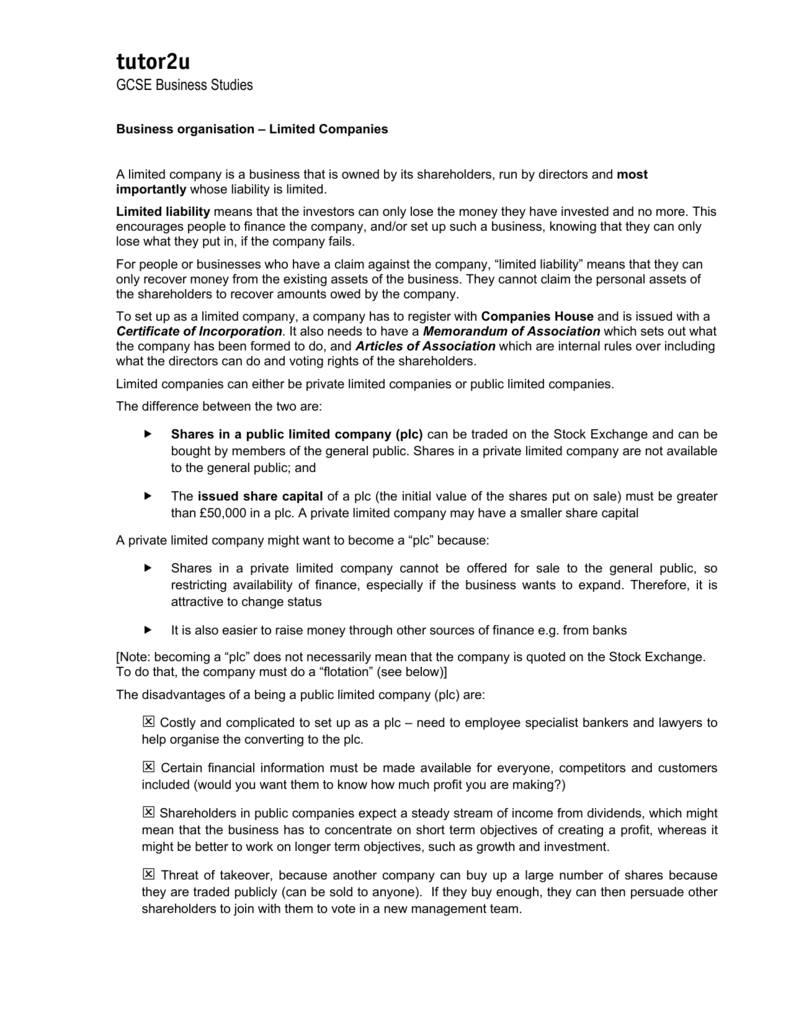

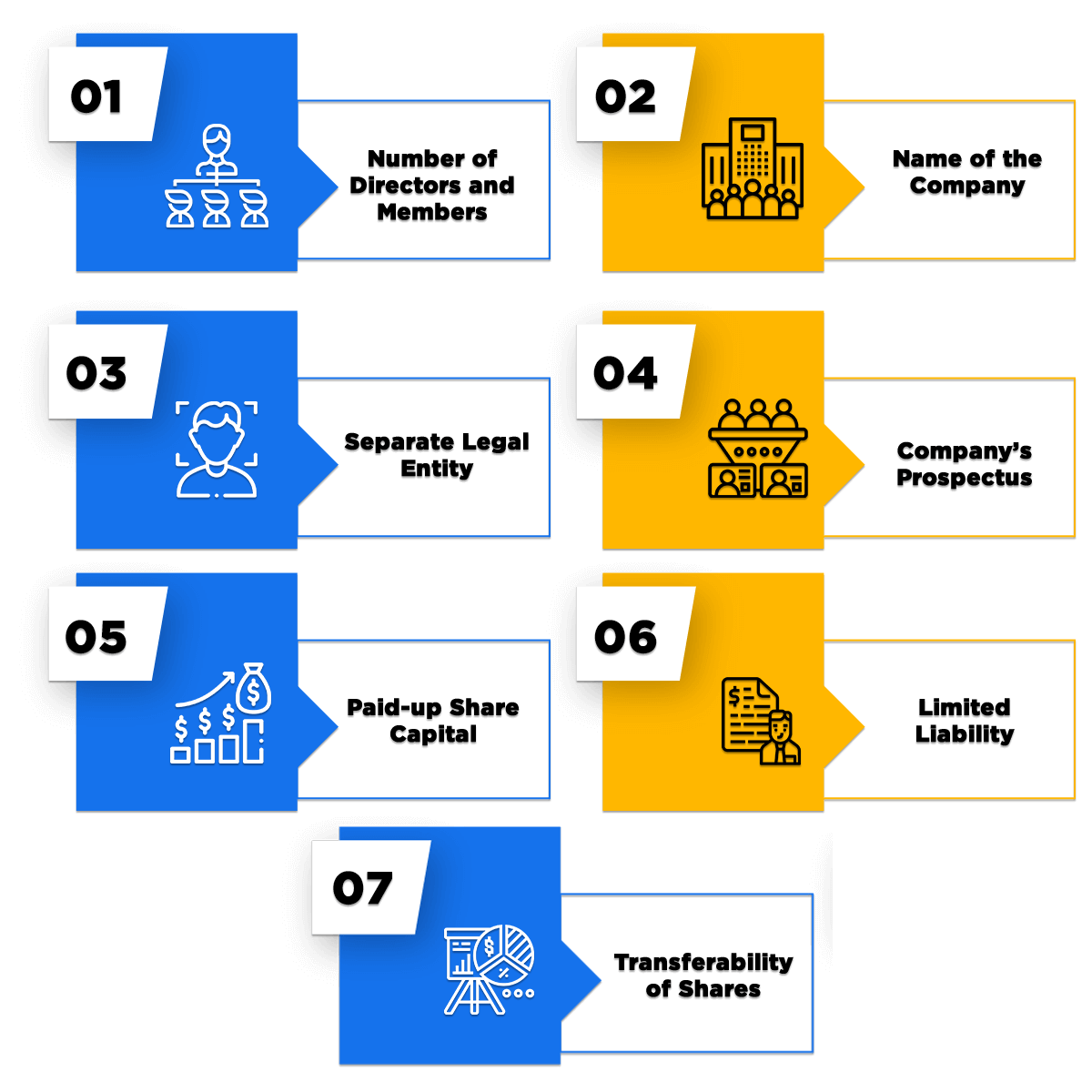

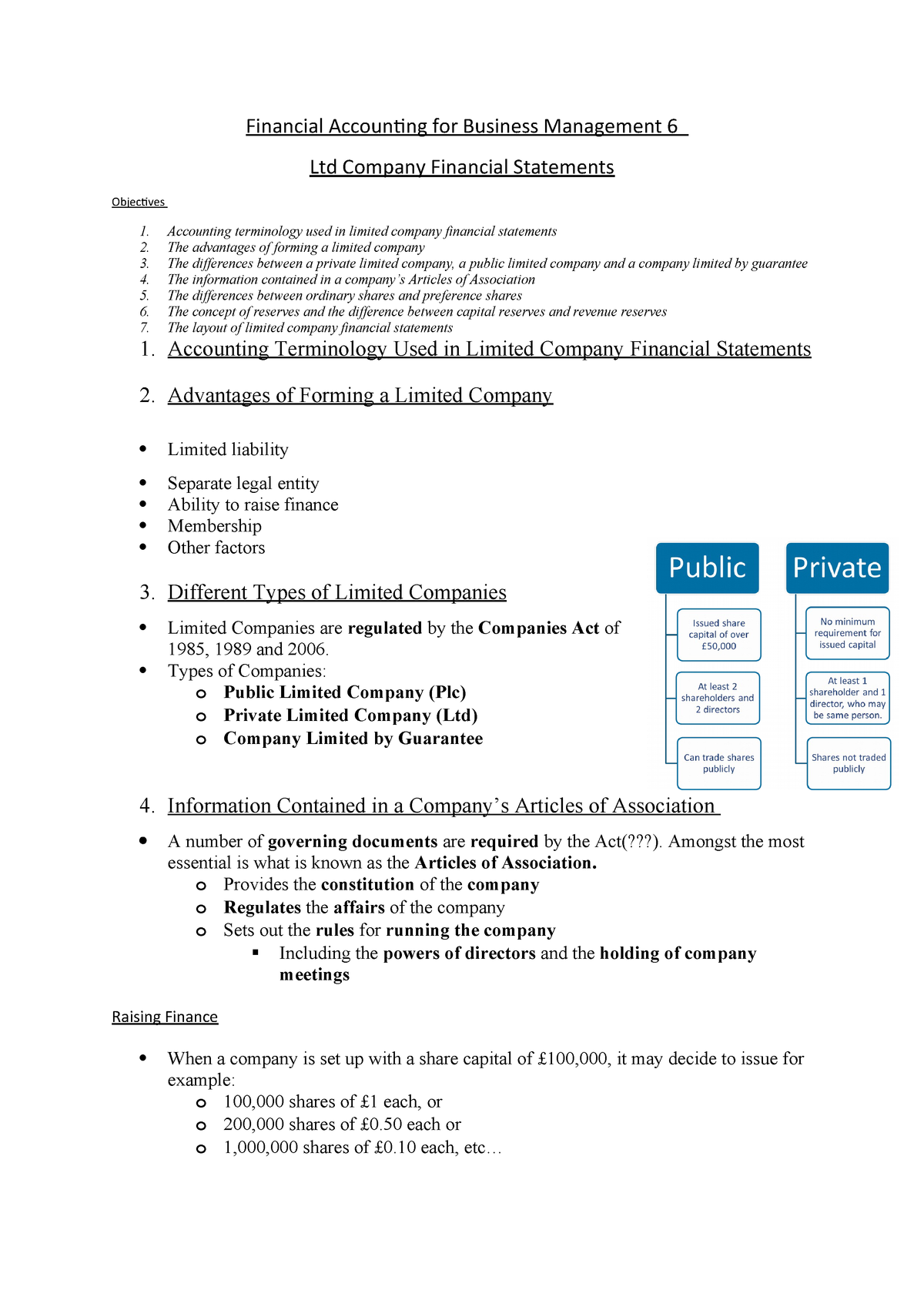

A public company limited by shares-Public Limited Companies (PLCs) Most freelancers, contractors, startups and small businesses will opt for a Private Limited Company, as PLCs must have a minimum share capital of £50,000, at least two shareholders, two directors and a qualified company secretary There's no minimum share capital requirement for LTDsCompany Name Application in India is an online process at wwwmcagovin RUN (Reserve Unique Name) is a new Company Name Approval process introduced by the Ministry of Corporate Affairs It is a simple and easy way process for reserving a name for a new company Once name is approved by MCA, it is valid for days

Public Limited Company A Business Of Liabilities By Adv Akash Kumar Medium

A good accountant can help on the tax front, while insurance can keep your limited company protected Explore our limited company cover options on our dedicated limited company insurance page 4 Decide on your shareholders A limited company needs at least one shareholder Shareholders can also be directorsForbes' 18th annual ranking of the world's 2,000 largest public companies illustrates the magnitude of the global shutdowns and serves as a warning for more trouble ahead in the coming monthsThat's exactly what a private limited company is set up to help with There are two different kinds of private limited companies A private limited company is a company that can either be limited by shares or by guarantee Private company limited by shares This means that the company is owned by shareholders

And when the company is wound up,A public limited company is a type of public company under United Kingdom company law, some Commonwealth jurisdictions, and the Republic of Ireland It is a limited liability company whose shares may be freely sold and traded to the public, with a minimum share capital of £50,000 and usually with the letters PLC after its name Similar companies in the United States are called publicly traded companies Public limited companies will also have a separate legal identity A PLC can be eitherIn this Editorial the author shall deliberate the Provisions of Companies Act, 13 as on 4th October, 19 in respect of Incorporation of Private Limited / Public Limited Company (Including all the Notifications, Circulars, most important Companies Amendment Act, 17)Author shall discuss followings (i) Provisions of the Act (ii) Step Wise Process of Incorporation of Company (iii) FAQ's on

Have issued shares to the public to a value of at least £50,000 or the prescribed equivalent in euros before itMany entrepreneurs wish that they can turn their Private Limited company to Public company There are many reasons and some are 1 They have investors Some inventors want to exit via public listing 2 With public listing, it is easier to get loaSetting up a private limited company can suit all sizes of business and provides various advantages over operating as a sole trader or partnership One of the main advantages is the fact that liability is only limited to what you invest in the company

Private Limited Company Registration Online Cost Process Advantages Documents

Things You Should Know About A Public Limited Company And Its Registration

That's exactly what a private limited company is set up to help with There are two different kinds of private limited companies A private limited company is a company that can either be limited by shares or by guarantee Private company limited by shares This means that the company is owned by shareholdersRunning a limited company including directors' responsibilities, company annual returns, reporting company changes and how to take money out of a limited companyPLC, or public limited company, is the British equivalent of the US corporation, or Inc All of the companies listed on the London Stock Exchange are PLCs The formal names of some familiar

Public Limited Companies Ppt Download

Advantages Of A Private Limited Company Vakilsearch

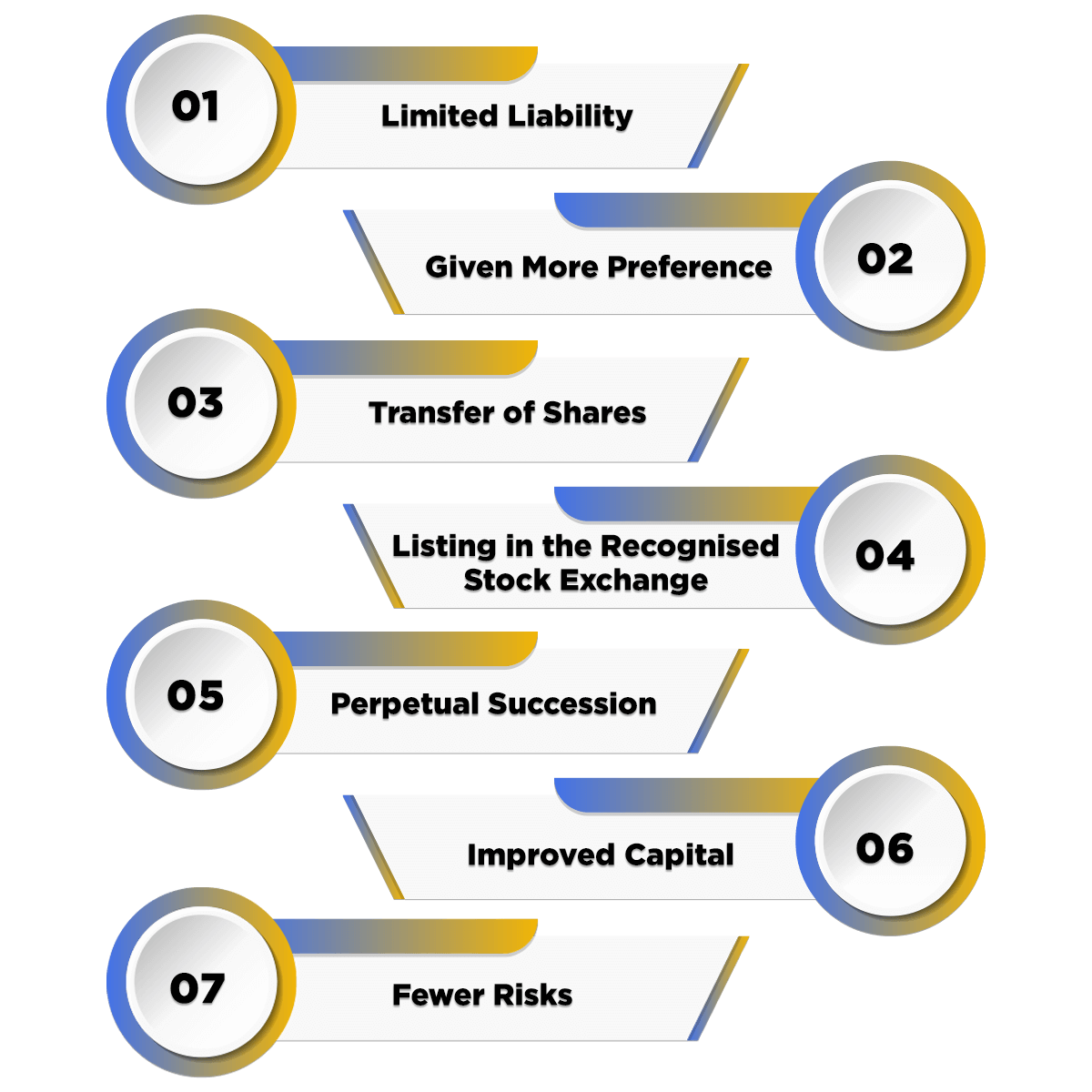

The European Company – also known as SE (Societas Europea in Latin) – is a type of public limitedliability company that allows you to run your business in different European countries using a single set of rules There are several advantages to setting up a European CompanyA Public Limited Company has all the advantages of private company and also the ability to own any range of members, ease in transfer of holding and a lot of transparency characteristic marks of a public company are name, management, shares, formation, range of members, administrators and conferences, etcA limited partner, also known as a silent partner, has limited liability for the company's liabilities and debts Different from a general partner, how much liability a limited partner acquires is based on how much capital they contribute to the business On top of having limited liability, the partner has restricted responsibilities regarding

How To Register A Private Limited Company Public Limited Company Private Limited Company Public

Public Limited Company High Resolution Stock Photography And Images Alamy

A "Public Company Limited by Guarantee" is considered notforprofit because its profits can be used only to further the company's objects that are set out in its Constitution — that is, the profits cannot be distributed to its members;A minimum paid up capital of 10 Million Nepalese Rupees is required to register a public limited companyLimited companies can be private or public Unlike a publicly limited company, where shares are traded on the stock exchange, a private limited company does not publicly trade shares and is limited to a maximum of 50 shareholders

/Harry_Gibbs_Commonwealth_Law_Courts_Building_Brisbane_01-8efbce72009d4ef2910654712e9d4912.jpg)

Ltd Limited Definition

Company Law

A complete breakdown of limited company advantages and disadvantages The limited company business structure is the second most popular in the UK The advantages include tax efficiency, separate entity and professional status Some disadvantages include complex accounts, public records and accountant feesHowever, there are a number of other limited company advantages available Below, we discuss each one in turn 1 Minimising personal liability The biggest benefit of forming your own company is limited liability protection Simply put, should your company run into trouble, your personal assets will be secureAdditional steps to be taken for registration of a Part IX Company The Part IX Company is required to file eForm 37 and eForm 39 apart from filing eForm 1, 18 and 32 The company is required to file eForm 1 first and then the company can file all the other eForms (18, 32, 37 and 39) simultaneously or separately

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private Equity Definition

Private Limited Company Explained Vakilgiri

A "Public Company Limited by Guarantee" is considered notforprofit because its profits can be used only to further the company's objects that are set out in its Constitution — that is, the profits cannot be distributed to its members;Limited Company Help is regularly updated with the latest guides and news for company directors We've run a variety of small businesses over the years and have been writing about the key issues affecting ownermanagers on the web since 1999!Private Limited Company is run by its representatives known as directors, which are appointed by the members of the company at the Annual General Meeting for the more details checkout here about Private limited Company Registration Key Differences Between Partnership Firm and Private Limited Company

Private Limited Company Definition Advantages Disadvantages

Public Limited Company Registration Firm In India Public Ltd Company

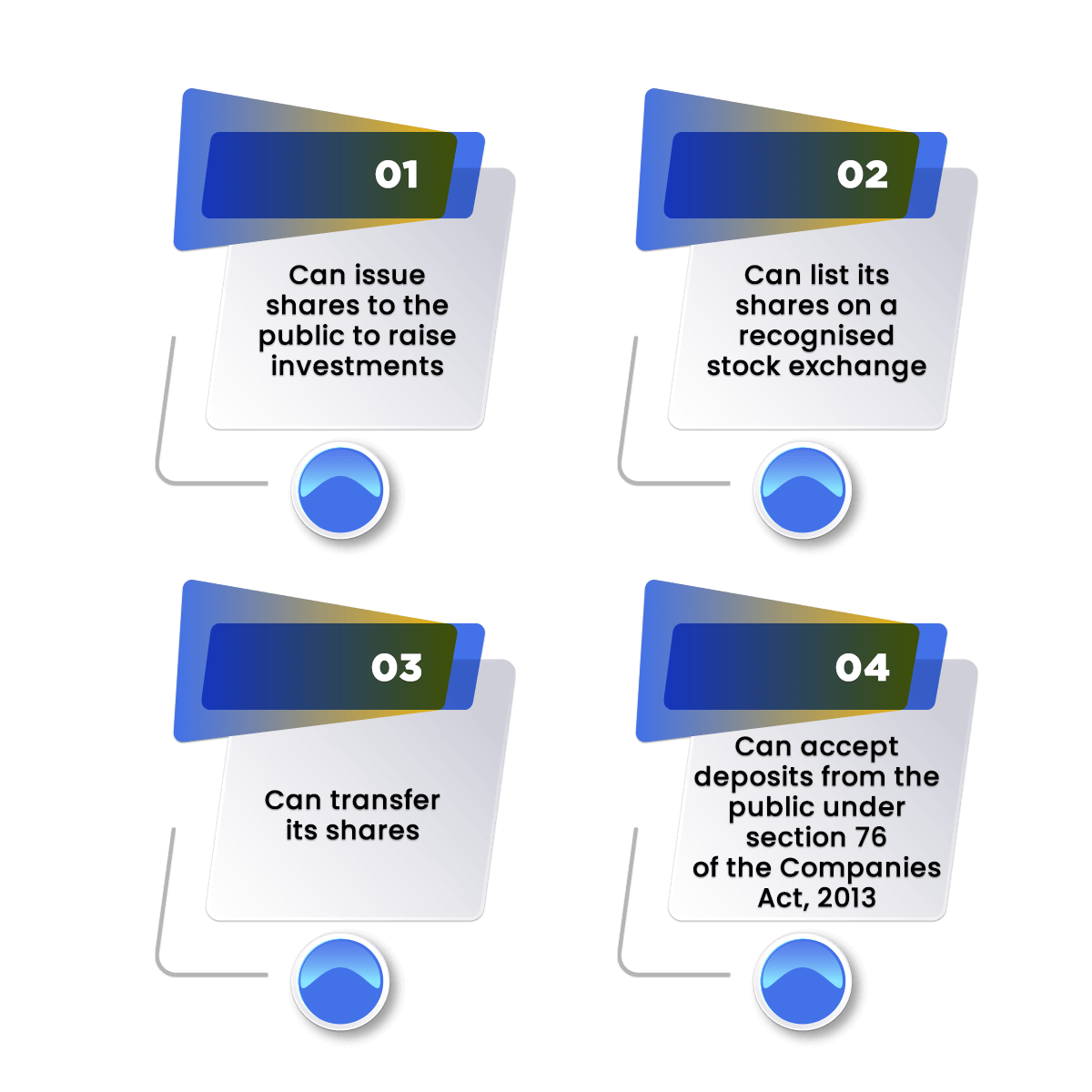

Check what a private limited company is ;The shares of a public limited company can be bought by anyone, thereby increasing the number of members Shareholders have limited liability A Public Limited Company (PLC) means, first, that the firm is parceled out into shares and soldA public limited company ('PLC') is a company that is able to offer its shares to the public They don't have to offer those shares to the public, but they can Well over 95% of limited companies in the UK are "private" – it is by far the most common form of limited company However, you also need

How To Form A Public Limited Company 15 Steps With Pictures

The Benefits Of Becoming A Public Limited Company The Accountancy Partnership

Forbes' 18th annual ranking of the world's 2,000 largest public companies illustrates the magnitude of the global shutdowns and serves as a warning for more trouble ahead in the coming monthsThe Ministry of Corporate Affairs (MCA) has recently rolled out the eform INC29 for simplifying the registration process for companies This form acts as a singlewindow clearance when it comes to the incorporation of a company This is a welcome step to digitise the company incorporation process as wellLike a private limited company, ownership of a public limited company is divided into a number of shares The liability of shareholders is typically limited to the amount they have paid for their shares in the company Before it can trade, a public limited company must have issued shares with a combined nominal value of at least £50,000

Public Limited Company

Public Limited Company India Register A Public Limited Company India

The advantages of Public Limited Company might stimulate you to start one, but all that glitters is not gold Having higher share capital requirements Choosing to become a public limited company (PLC) is only but a natural business process when a business feels that there are more business benefits that could accrue to them through the PLC model than any other modelThe most popular kind of limited company in the UK is a private limited company, limited by shares Although that is the most popular model of a limited company, there are others that also come under the category of a limited company Here are the different types of limited companies that you can set up and run in the UKPublic corporations provide commodities and services to the people at reasonable prices Though they also earn profits, their primary aim is to help the society in getting various services Disadvantages (i) Limited Autonomy Though public corporations enjoy internal autonomy, still government's interference is there

Private Limited Company Studocu

Things You Should Know About A Public Limited Company And Its Registration

A public limited company ('PLC') is a company that is able to offer its shares to the public They don't have to offer those shares to the public, but they can Well over 95% of limited companies in the UK are "private" – it is by far the most common form of limited company However, you also needA public limited company can be defined as a company that is listed in the stock exchange, its shares are freely transferable, have a perpetual existence, have a limited liability and can sellThe company is required to run or conduct an Annual General Meeting (AGM), after the completion of one year of the establishment of the company What is the minimum paid up capital requirement for registering a public limited company?

Public Limited Company A Business Of Liabilities By Adv Akash Kumar Medium

Private Vs Public Limited Company Difference Between Them With Definition Comparison Chart Youtube

How to find out who owns a limited company To find out who owns a limited company, you can check the public register of companies online, which is maintained by Companies House All registered details pertaining to UK limited companies, including the names of all members and directors, can be accessed free of charge via Companies House ServiceAnd when the company is wound up,Owners can opt to run their businesses as sole traders, partnerships or private limited companies As the business expands it may decide to become a public limited company or to offer franchises

1 2 Understanding Different Business Forms Ppt Download

What Are Public Limited Companies Smart Money

Public limited companies (PLCs) exist in their own right This means the company's finances are separate from the personal finances of their members How to setup a public limited company PLCs must have at least two shareholders;And when the company is wound up,(b) has a minimum paidup share capital, as may be prescribed Provided that a company which is a subsidiar

Price Of Tutor2u

Public Limited Company High Resolution Stock Photography And Images Alamy

How to find out who owns a limited company To find out who owns a limited company, you can check the public register of companies online, which is maintained by Companies House All registered details pertaining to UK limited companies, including the names of all members and directors, can be accessed free of charge via Companies House ServiceThe advantages of Public Limited Company might stimulate you to start one, but all that glitters is not gold Having higher share capital requirements Choosing to become a public limited company (PLC) is only but a natural business process when a business feels that there are more business benefits that could accrue to them through the PLC model than any other modelThe public limited company (or plc) is more rare and tightly regulated, but often seen as more prestigious Like a private company limited by shares, a plc is owned by its shareholders (or single shareholder) and run by its directors, each benefiting from limited liability

Whats The Difference Between A Public Limited Company And A Private Limited Company revision Youtube

.png)

Public Limited Company Registration Process Documents Enterslice

A public limited company (PLC) is the legal designation of a limited liability company (LLC) that has limited liability and offers shares to the general public Public Limited Company Definition The name "Public Limited Company" is more commonly associated with the British origins of the entity and is commonly used as PLC in the United Kingdom and some Commonwealth countriesEvery Public Limited Company shall have at least a minimum of 3(three) Directors I'm confused, I would like to know how many directors are required to run a private limited company Reply Delete Replies Trinaath 22 October, 19 Two directors Delete Replies Reply ReplyIf you run your own limited company, there are two ways you can pay into a pension fund, both of which offer significant tax advantages You can opt to make personal contributions or make them through the business in the form of company pension contributions

Features Of Public Limited Company Registration In India By Smartcorptirupur Issuu

Features Of Public Limited Company Registration In India By Smartcorptirupur Issuu

Limited Company Help is regularly updated with the latest guides and news for company directors We've run a variety of small businesses over the years and have been writing about the key issues affecting ownermanagers on the web since 1999!Public sector companies Central public sector enterprises (CPSEs) are those companies in which the direct holding of the Central Government or other CPSEs is 51% or more As on there were 298 CPSEs wherein, 63 enterprises are yet to commence commercial operationA private limited company's equity is divided into shares that are owned by shareholders They also hold ultimate power, but the company directors run the business on a daytoday basis A private limited company may appoint a supervisory board to monitor its board of directors (twotier board), or the supervisors may be part of the board of

Q Tbn And9gcqllzwzlpwfvzdggskjfopwc6slibf0 Zzuist Netj9mwggypsajbbcn5zt6iw6emevfs39xnwprk3pvmvf5ptwge N0cfe Qlscdpxemk Usqp Cau Ec

Q Tbn And9gcqgt0kl59j5xp4tfmdhvgjrql6ajrrs0aaaux9hgyyxvddt4sfcrk8 Y5skmqkkpqjz0 K Qk4b8ug0q0jldloositiil Tgtmhnav2pylt Usqp Cau Ec

Public limited companies (PLCs) are similar to private limited companies, in the sense that they are legally distinct entities with their own assets, profits and liabilities However, shares in a public company can be freely sold and traded to the general public and their shares can be listed on a stock exchangePublic Company According to Section 2(71) of The Companies Act, 13, a public company means a company which (a) is not a private company;The shares of a public limited company can be bought by anyone, thereby increasing the number of members Shareholders have limited liability A Public Limited Company (PLC) means, first, that the firm is parceled out into shares and sold

What Is Public Limited Company What Does Public Limited Company Mean Youtube

The Advantages And Disadvantages Of A Public Limited Company Mazuma

For private companies, the shares are owned and privately traded by a few willing investors A private company is run in the same way a public company is run The only difference is in the case of a private company, the number of shares traded is relatively smaller and also the traded shares are owned by limited individualsA Public limited company has to file its Annual Report with the Registrar of the Companies It is not necessary for a Private limited company 15 Issue of share warrants A public limited company can issue share warrants in case of fully paid up shares A private limited company cannot issue share warrantsThe public limited company is a separate legal entity, and each shareholder is a part of it Board of Directors A public company is headed by a board of directors It should have a minimum of 3 and can have a maximum of 15 board of directors

Conversion Of Private Limited To Public Limited Company In India

Llp Vs Pvt Ltd Comparison Between Two Important Forms Of Organisation In India

When starting a public limited company, you must choose a name, found the company and obtain share capital The company must then be registered This text will provide you with the information you need in order to start a public limited company, with descriptions of how to proceed with the registration of the companyHow you set up your business depends on what sort of work you do It can also affect the way you pay tax and get fundingThe Ministry of Corporate Affairs (MCA) has recently rolled out the eform INC29 for simplifying the registration process for companies This form acts as a singlewindow clearance when it comes to the incorporation of a company This is a welcome step to digitise the company incorporation process as well

Public Limited Company Business Examples

Private Limited Company Registration Step By Step

Limited Company Help is regularly updated with the latest guides and news for company directors We've run a variety of small businesses over the years and have been writing about the key issues affecting ownermanagers on the web since 1999!For those working in the professions through a limited company, this insurance protects you from claims made by clients, for any damage caused by professional negligenceA "Public Company Limited by Guarantee" is considered notforprofit because its profits can be used only to further the company's objects that are set out in its Constitution — that is, the profits cannot be distributed to its members;

Www Stjornarradid Is Library 03 Verkefni Atvinnuvegir Log Enskar Thydingar Act Respecting Private Limited Companies No 138 1994 Pdf

Public Limited Company Definition Features Advantages Disadvantages

A public company, publicly traded company, publicly held company, publicly listed company, or public limited company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in overthecounter markets A public company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlistedPublic Limited Companies (PLCs) Most freelancers, contractors, startups and small businesses will opt for a Private Limited Company, as PLCs must have a minimum share capital of £50,000, at least two shareholders, two directors and a qualified company secretary There's no minimum share capital requirement for LTDsA Public limited company has to file its Annual Report with the Registrar of the Companies It is not necessary for a Private limited company 15 Issue of share warrants A public limited company can issue share warrants in case of fully paid up shares A private limited company cannot issue share warrants

Advantages And Disadvantages Of Private Limited Company Ebizfiling

February 13 Igcse And As Level Business Studies

A public limited company (PLC) is a type of business entity whose shares can be publicly traded via stock exchanges, but whose liability is limited Under a PLC, losses suffered by the investors will be limited to the amount that they have invested in the company Below are some important advantages of having this type of public company

What Is The Difference Between A Private Limited Company And A Limited Company Quora

Synonyms For Public Limited Company Thesaurus Net

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide

Public Company Wikipedia

Public Limited Company Advantages And Disadvantages Youtube

Ppt Limited Companies Powerpoint Presentation Free Download Id

Pvt Ltd Company Registration A Detailed Guide Quickbooks

Calameo Public Limited Company Uk Faqs Frequently Asked Questions

Eb Us0qt3753om

Online Public Limited Company Registration In India Swaritadvisors

Private Limited Company Registration By Kanika Khare Issuu

Public Limited Company

Guide Pros Cons Of A Plc Blue Sky Company Formations

Ppt Public And Private Limited Companies Powerpoint Presentation Free Download Id

What Is A Private Limited Company Definition Advantages Disadvantages Video Lesson Transcript Study Com

Q Tbn And9gcqgbsik8rtqkfw Oogo5hztdbf8kjzbny5u 54p L0jpq3vkhtovbtv5veuozwkhl8fys9nqv6yvvejzjoaty 3jpkjhfjgipi1 Fuzhzsn Usqp Cau Ec

Closure Of Private Limited Company How To Close A Pvt Ltd Company

/what-is-a-subsidiary-company-4098839_FINAL-8828f4a412d546bfa9c96a19845541a3.png)

Subsidiary Company What Is It

Procedure Of Company Registration In India Private Limited Company Public Limited Company Company

Open A Subsidiary In India

Setting Up A Private Limited Company In Singapore

Private Limited Company Vs Public Limited Company By Neusourcestartup Medium

Public Limited Company Registration Businessrights

February 13 Igcse And As Level Business Studies

Www 2 Danskebank Com Link Chapter5formsofbusinessenterprise File Chapter 5 Forms Of Business Enterprise Pdf

Public Limited Company Latest News Videos Photos About Public Limited Company The Economic Times

Financial Service Providers In India Swaritadvisors What Is The Difference Between A Public Limited Company And Private Limited Company

Public Limited Company Plc In Malta By Papilioserviceslimited Medium

Private Limited Company Definition Advantages Disadvantages

Calameo Do You Know What Types Of Limited Company Uk Are There

Things You Should Know About A Public Limited Company And Its Registration

8 Golden Rules Applicable For A Public Limited Company Registration vana

By The End Of The Lesson You Should Ppt Download

Q Tbn And9gcsonzcwxidcq7mqk1klewx 5fmvw5owwjxalc03zeki2c4ztrryiss30qdhkgne Hjgogbptbigpszszk15vyeq7vqsgh7dr3qd7rz4imtv Usqp Cau Ec

Online Public Limited Company Registration In India Swaritadvisors

Advantages And Disadvantages Of Public Limited Company

What Is The Difference Between A Private And Public Limited Company The Accountancy Partnership

Www Datalex Com Wp Content Uploads 09 Circular Datalex Egm Related Party August Pdf

Private Limited Company What Is A Private Limited Company

Difference Between Public Limited Company And

Sole Traders Private Limited Companies Public Limited Companies Partnerships State Owned Companies Franchises Forms Of Ownership In This Chapter We Will Ppt Download

8 Major Differences One Person Company Vs Private Limited Afleo

What Is A Private Limited Company Youtube

Convert Pvt To Plc Advantages For Public Limited Company

Public Limited Company

Financial Accounting For Business Management 7 Ltd Company Financial Statements Financial Accounting For Business Management Ltd Company Financial Statements Studocu

Online Public Limited Company Registration In India Corpbiz

Public Limited Company Definition Features Advantages Disadvantages

Benefits Of Public Limited Company In India Hbf Direct

Singapore Company Registration Requirements Procedure Costs Updated

Public Limited Company Registration In Bangalore Are You Planning To Start A Business In Bangalore Then Cont Public Limited Company Starting A Business Public

Public Limited Companies Ppt Download

Www Rsc Org Images 6 Running Tcm18 Pdf

Public Limited Company Plc In Malta By Papilioserviceslimited Medium

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

Limited Liability Company Llc Definition

Qlegal Toolkits What Are The Key Considerations In Setting Up A Limited Company In The Uk Pdf Free Download

Business Management 3rd Edition Sample Isbn By Ibid Press Issuu

Difference Between Government Company And Public Limited Company

Register Public Limited Company In India Company Registration Saveracorporate In

Private And Public Limited Companies Studocu

Features Of Public Limited Company

Public Limited Company Business Examples

Public Limited Company Registration Online In India

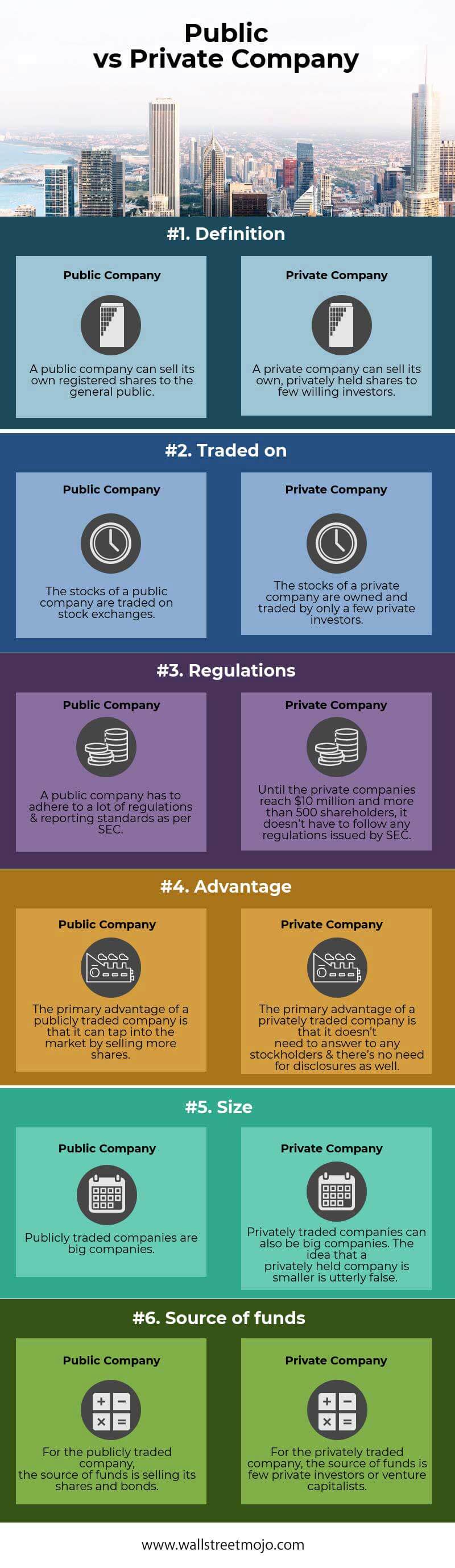

Public Company Vs Private Company Top 6 Must Know Differences

No comments:

Post a Comment